H.R. 3137: Biodiesel Tax Credit Extension Act of 2025

The Biodiesel Tax Credit Extension Act of 2025 aims to extend existing tax credits for biodiesel and renewable diesel fuels, as well as biodiesel mixtures, through 2026. Here are the key provisions:

Extension of Tax Credits

The bill proposes to extend the following tax credits:

- Biodiesel and Renewable Diesel Credit: This credit, which benefits producers of biodiesel and renewable diesel, will be extended from the current expiration date of 2024 to 2026. This change is meant to encourage the production and use of these fuels.

- Biodiesel Mixture Credit: Similar to the biodiesel credit, this extension will also push the expiration date from 2024 to 2026, supporting biodiesel mixtures that are blended with other fuels.

Denial of Double Benefit

The bill includes provisions to prevent individuals or companies from receiving multiple tax benefits for the same fuel. Specifically:

Coordination with Clean Fuel Production Credit

The legislation also addresses coordination between the alcohol fuel credit and the clean fuel production credit. Key points include:

- It specifies that if a fuel qualifies for a benefit under section 45Z(a), it will not receive additional credits under the alcohol fuel provisions.

- Additionally, another provision will extend the timeline for claiming credits related to second generation biofuel production until 2027.

Effective Dates

The amendments outlined in the bill will take effect for fuel sold or used after December 31, 2024, providing a clear timeline for producers and users of biodiesel and renewable diesel.

Impact of the Bill

This bill aims to incentivize the continued production and use of biodiesel and related fuels, aligning with environmental and energy goals to support renewable energy sources.

Relevant Companies

- Dart Energy (DARR): As a company involved in biodiesel production, this extension may benefit Dart by potentially increasing demand for its biodiesel products due to the extended tax credits.

- Renewable Energy Group (REGI): A large producer of biodiesel, Renewable Energy Group would likely experience a positive impact from the extension of incentives, encouraging continued production.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

17 bill sponsors

-

TrackMike Carey

Sponsor

-

TrackMike Bost

Co-Sponsor

-

TrackNikki Budzinski

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackJim Costa

Co-Sponsor

-

TrackRandy Feenstra

Co-Sponsor

-

TrackAndrew R. Garbarino

Co-Sponsor

-

TrackJared F. Golden

Co-Sponsor

-

TrackAshley Hinson

Co-Sponsor

-

TrackDusty Johnson

Co-Sponsor

-

TrackMike Kelly

Co-Sponsor

-

TrackDarin LaHood

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

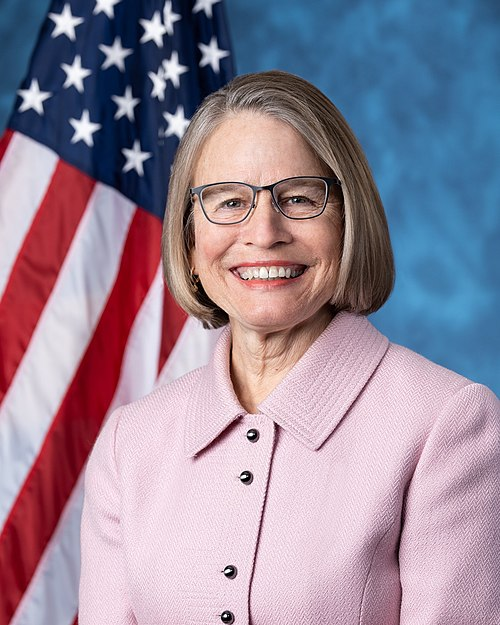

TrackMariannette Miller-Meeks

Co-Sponsor

-

TrackZachary Nunn

Co-Sponsor

-

TrackEric Sorensen

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| May. 01, 2025 | Introduced in House |

| May. 01, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.