H.R. 3105: Promotion and Expansion of Private Employee Ownership Act of 2025

This bill, titled the Promotion and Expansion of Private Employee Ownership Act of 2025

, aims to amend existing laws to promote employee ownership in S corporations through employee stock ownership plans (ESOPs). Here are the key provisions:

Tax Deferral for Sales of Stock to ESOPs

The bill proposes to allow full deferral of tax on certain sales of stock to an ESOP sponsored by an S corporation. This means that when owners sell their shares to an ESOP, they will not have to pay taxes on that income immediately but can defer the taxes until a later date. The amendment also removes existing limitations on this tax deferral, effectively allowing these sales to be tax-free upon the enactment of this law.

Creation of the Employee Ownership Assistance Office

Within 90 days of the bill's enactment, the Secretary of the Treasury is required to establish an S Corporation Employee Ownership Assistance Office. This office will:

- Provide education and outreach to inform companies and individuals about the benefits and possibilities of employee ownership.

- Offer technical assistance to help S corporations set up and manage ESOPs.

Amendments to the Small Business Act

The bill proposes changes to the Small Business Act to ensure that small businesses can retain their status even after an ESOP acquires over 49% of their stock. It clarifies that for determining eligibility for benefits under the Small Business Act, each ESOP participant will be considered to own a proportionate share of the business.

Establishment of an Advocate for Employee Ownership

The bill calls for the appointment of an Advocate for Employee Ownership by the Secretary of Labor. The Advocate's responsibilities will include:

- Consulting with the Employee Ownership Initiative.

- Acting as a liaison between various stakeholders in employee ownership.

- Providing education and assistance to promote and expand employee ownership.

- Facilitating communication and assistance related to disputes within ESOPs.

- Recommending legislative and regulatory changes to enhance employee ownership.

Additionally, the Advocate is required to submit an annual report detailing activities and recommendations related to improving employee ownership practices.

Effective Dates

The amendments regarding tax deferral and small business status will take effect upon the enactment of this legislation, while certain other changes are scheduled to occur in the following calendar year.

Goals of the Bill

The overarching aim of this legislation is to preserve and foster employee ownership in S corporations, ensuring that more employees have a stake in the business and can benefit from their work through ownership and retirement savings.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

35 bill sponsors

-

TrackMike Kelly

Sponsor

-

TrackMichael Baumgartner

Co-Sponsor

-

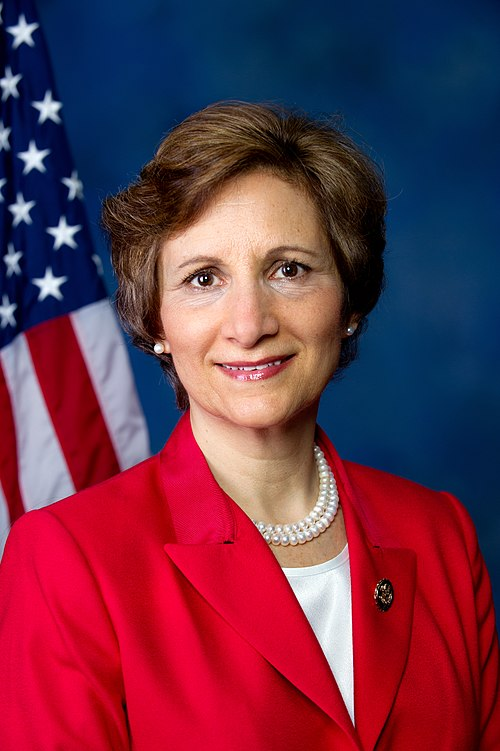

TrackSuzanne Bonamici

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackEd Case

Co-Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackSharice Davids

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackTroy Downing

Co-Sponsor

-

TrackRon Estes

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackScott Franklin

Co-Sponsor

-

TrackGlenn Grothman

Co-Sponsor

-

TrackYoung Kim

Co-Sponsor

-

TrackCarol D. Miller

Co-Sponsor

-

TrackBarry Moore

Co-Sponsor

-

TrackBlake D. Moore

Co-Sponsor

-

TrackNathaniel Moran

Co-Sponsor

-

TrackZachary Nunn

Co-Sponsor

-

TrackBurgess Owens

Co-Sponsor

-

TrackJimmy Panetta

Co-Sponsor

-

TrackDavid Rouzer

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackBradley Scott Schneider

Co-Sponsor

-

TrackTerri A. Sewell

Co-Sponsor

-

TrackAdrian Smith

Co-Sponsor

-

TrackLloyd Smucker

Co-Sponsor

-

TrackW. Gregory Steube

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

TrackGlenn Thompson

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

TrackRudy Yakym III

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 30, 2025 | Introduced in House |

| Apr. 30, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committees on Small Business, and Education and Workforce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.