H.R. 2972: EITC for Older Workers Act of 2025

This bill, known as the **EITC for Older Workers Act of 2025**, aims to change the eligibility criteria for the Earned Income Tax Credit (EITC), specifically in relation to older workers. Here is a summary of its main components:

Repeal of Upper Age Limit

The bill proposes to remove the existing upper age limit of 65 years for eligibility to receive the Earned Income Tax Credit. Under current law, individuals who have not yet reached the age of 65 are eligible to claim the EITC based on their earned income, but those who are 65 years old and older are excluded from receiving this tax credit. This legislation seeks to amend that by allowing individuals of any age to qualify for the EITC, as long as they meet the other requirements.

Effective Date

The changes introduced by this bill would apply to taxable years beginning after December 31, 2025. This means that the new eligibility criteria allowing those over 65 to claim the EITC would not take effect until the 2026 tax year and beyond.

Implications

By repealing the upper age limit, the bill aims to benefit older workers who have earned income but previously could not access the EITC due to their age. This may provide additional financial support for older individuals who continue to work and earn income past the traditional retirement age, potentially impacting their financial security and quality of life.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

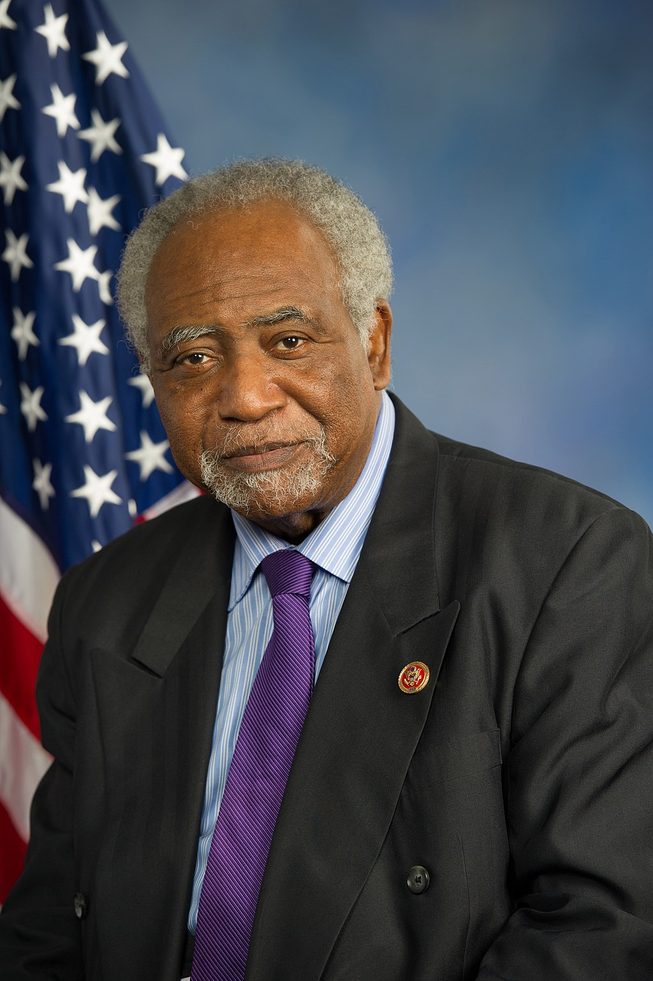

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 21, 2025 | Introduced in House |

| Apr. 21, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.