H.R. 2928: Mortgage Relief for Disaster Survivors Act

This bill, known as the Mortgage Relief for Disaster Survivors Act, aims to provide financial relief to borrowers with federally backed mortgage loans who are affected by major disasters or emergencies. Here are the key components of the bill:

1. Forbearance Assistance

The bill allows borrowers who have federally backed mortgage loans for properties that have been damaged or destroyed by a disaster to request a temporary suspension (forbearance) of their mortgage payments.

2. Eligibility and Process for Requesting Forbearance

- Eligibility: To qualify for this forbearance, the property must be located in a disaster area and have a federally backed mortgage.

- Request Process:

- Borrowers must submit a written request for forbearance to their mortgage servicer.

- Borrowers need to provide documentation proving damage or destruction to their property.

3. Duration of Forbearance

Once a request for forbearance is received, mortgage servicers are required to grant a forbearance for:

- A period of 180 days, regardless of the borrower’s payment delinquency status.

- Borrowers can request an extension of the forbearance for an additional 180 days if needed.

4. Right to Discontinue Forbearance

Borrowers have the option to discontinue the forbearance at any time during the granted period.

5. Accrual of Fees and Interest

During the forbearance period, no fees, penalties, or additional interest (beyond the amounts that would have been due if all payments were made on time) will be accrued on the borrower’s account.

6. Definitions

- Covered Mortgage Loan: Refers to any federally backed mortgage or multifamily mortgage loan.

- Covered Period: The time frame that starts at the declaration of a disaster and ends when that declaration is lifted.

- Disaster: A major disaster or emergency declared by the President.

- Disaster Area: An area defined as affected by the disaster declaration.

- Federally Backed Mortgage Loan: Includes loans secured by residential properties, which are either purchased or securitized by specific federal entities.

- Federally Backed Multifamily Mortgage Loan: Loans secured by properties designed for occupancy by five or more families that are similarly purchased or securitized.

Relevant Companies

- FNMA (Federal National Mortgage Association): As a major entity in the secondary mortgage market, FNMA could see impacts in terms of the loans they securitize and guarantee, especially in the wake of increased disaster-related forbearances.

- FMCC (Federal Home Loan Mortgage Corporation): FMCC also plays a significant role in providing liquidity in the mortgage market and could be affected by the additional forbearance requests stemming from disaster relief efforts.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

13 bill sponsors

-

TrackJudy Chu

Sponsor

-

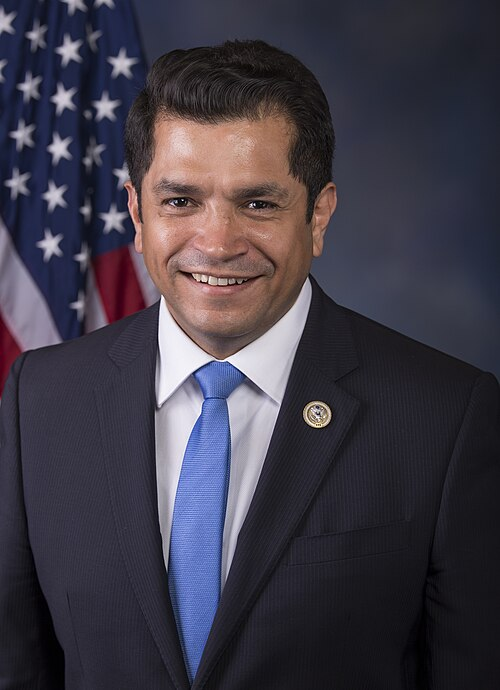

TrackJ. Luis Correa

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackLaura Friedman

Co-Sponsor

-

TrackSylvia R. Garcia

Co-Sponsor

-

TrackJimmy Gomez

Co-Sponsor

-

TrackJared Huffman

Co-Sponsor

-

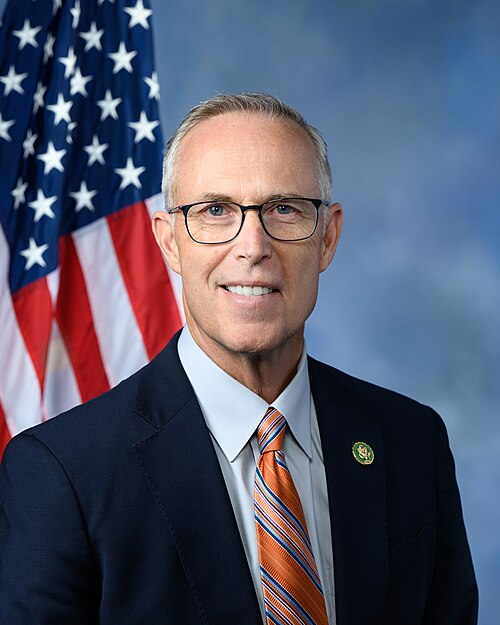

TrackJoe Neguse

Co-Sponsor

-

TrackAyanna Pressley

Co-Sponsor

-

TrackBrad Sherman

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 17, 2025 | Introduced in House |

| Apr. 17, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.