H.R. 2854: Neighborhood Homes Investment Act

The Neighborhood Homes Investment Act is designed to improve distressed communities by promoting affordable homeownership and housing rehabilitation for low-income families. The main components of the bill include:

Tax Credit for Revitalization

The Act introduces a tax credit that incentivizes investments in areas suffering from housing shortages. This is aimed at both encouraging developers and providing support to families looking to purchase or improve homes.

Focus on Low-Income Families

The legislation underscores the importance of empowering low-income families by facilitating access to affordable housing options. This plan is intended to help these families achieve homeownership, which is often a pathway to better financial stability.

Credit Allocation and Application Process

The bill outlines specific procedures for how the tax credits will be allocated. This includes guidelines on how applicants can apply for these credits, ensuring that there is a clear and transparent process for interested parties.

Community Impact Assessments

As part of the implementation of the tax credits, community impact assessments are required. These assessments will evaluate how the investments affect the local communities, focusing on improvements in housing conditions, economic development, and overall community well-being.

Goals of the Act

- Revitalize neighborhoods facing economic challenges.

- Improve access to affordable housing for low-income families.

- Encourage sustainable community development.

- Support local economies through housing-related investments.

Overall Vision

The Neighborhood Homes Investment Act aims to create a positive feedback loop where improvements in housing lead to enhanced community environments, benefiting both residents and local businesses. By targeting investments in distressed areas, the Act seeks to tackle issues of housing inadequacy and economic stagnation.

Relevant Companies

- PHM - PulteGroup, as a major homebuilder, may be impacted as the demand for affordable housing increases.

- DHI - D.R. Horton, which specializes in residential construction, could see increased opportunities in revitalized neighborhoods.

- KBH - KB Home might experience direct effects due to potential growth in affordable housing projects.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

57 bill sponsors

-

TrackMike Kelly

Sponsor

-

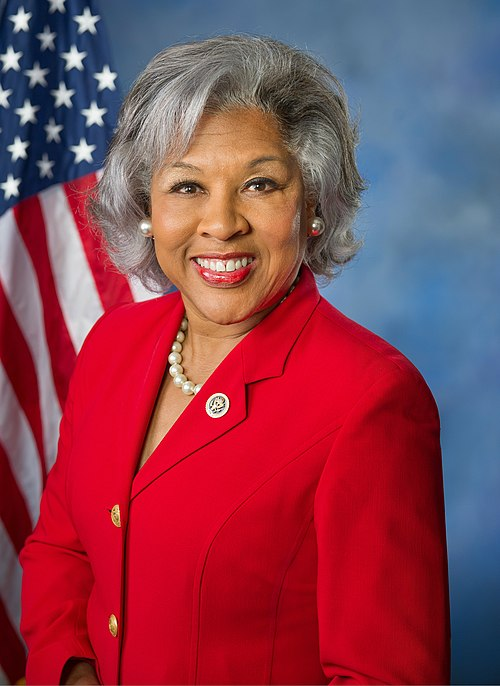

TrackJoyce Beatty

Co-Sponsor

-

TrackSanford D. Bishop, Jr.

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackVern Buchanan

Co-Sponsor

-

TrackNikki Budzinski

Co-Sponsor

-

TrackMike Carey

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackJ. Luis Correa

Co-Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackSharice Davids

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

TrackDiana DeGette

Co-Sponsor

-

TrackDebbie Dingell

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackRandy Feenstra

Co-Sponsor

-

TrackMichael Guest

Co-Sponsor

-

TrackJahana Hayes

Co-Sponsor

-

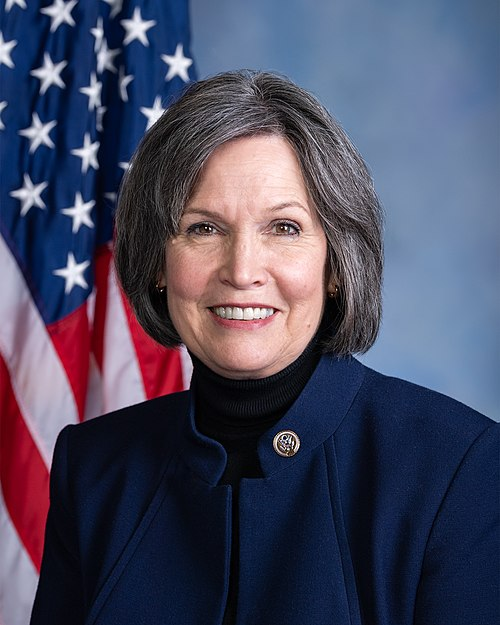

TrackAshley Hinson

Co-Sponsor

-

TrackChrissy Houlahan

Co-Sponsor

-

TrackTrent Kelly

Co-Sponsor

-

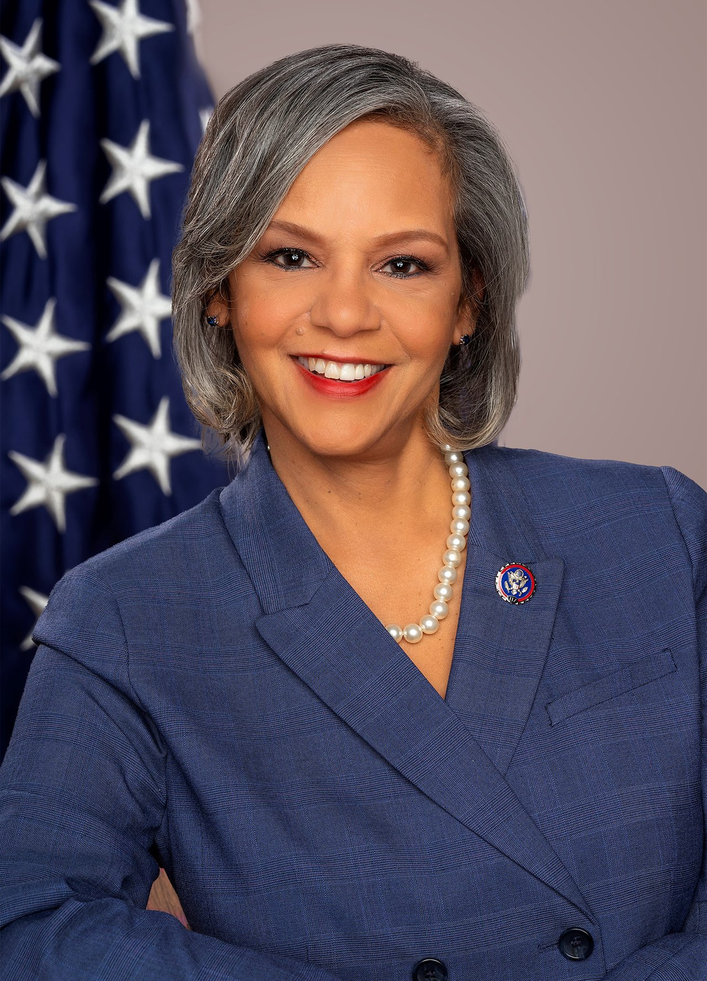

TrackRobin L. Kelly

Co-Sponsor

-

TrackRo Khanna

Co-Sponsor

-

TrackRaja Krishnamoorthi

Co-Sponsor

-

TrackDavid Kustoff

Co-Sponsor

-

TrackDarin LaHood

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackJohn B. Larson

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackNicole Malliotakis

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

TrackLucy McBath

Co-Sponsor

-

TrackBetty McCollum

Co-Sponsor

-

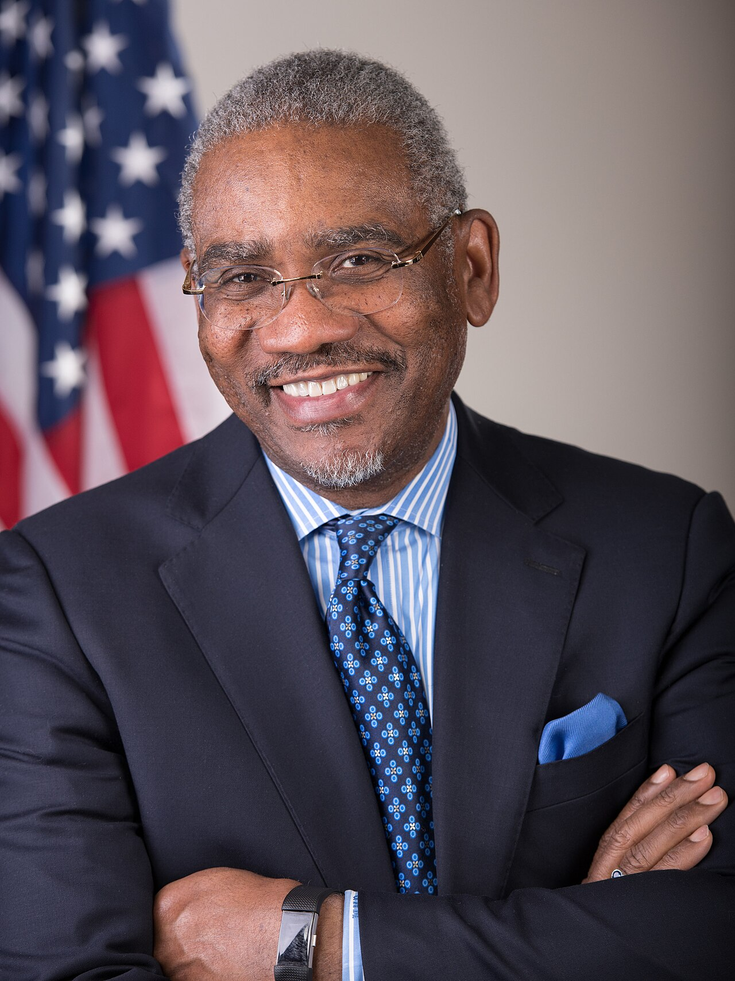

TrackGregory W. Meeks

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackCarol D. Miller

Co-Sponsor

-

TrackNathaniel Moran

Co-Sponsor

-

TrackFrank J. Mrvan

Co-Sponsor

-

TrackJoe Neguse

Co-Sponsor

-

TrackZachary Nunn

Co-Sponsor

-

TrackIlhan Omar

Co-Sponsor

-

TrackJimmy Panetta

Co-Sponsor

-

TrackScott H. Peters

Co-Sponsor

-

TrackBrittany Pettersen

Co-Sponsor

-

TrackMichael A. Rulli

Co-Sponsor

-

TrackJohn H. Rutherford

Co-Sponsor

-

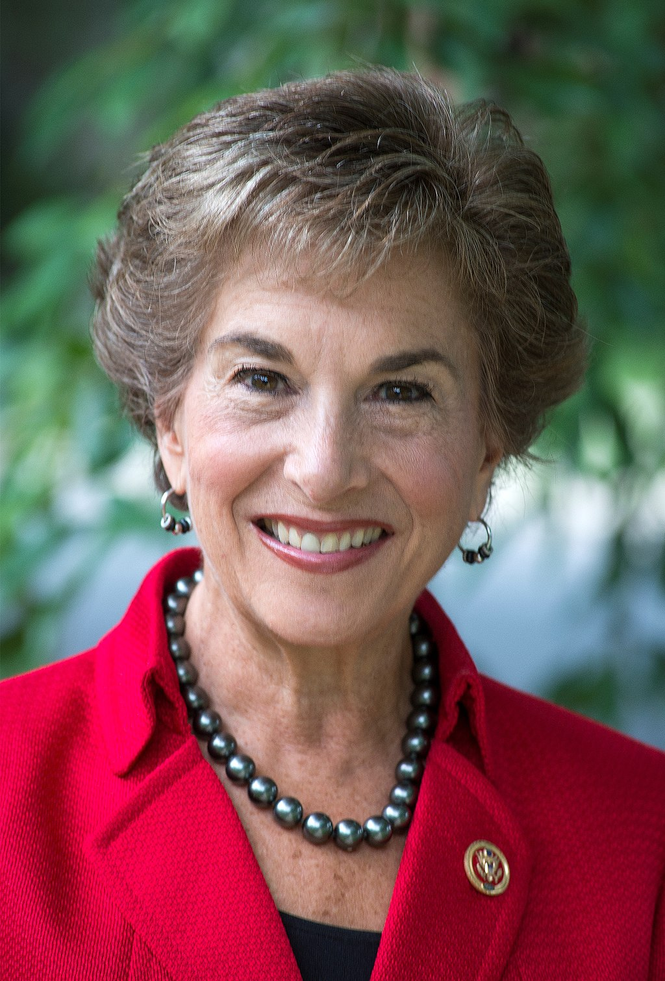

TrackJanice D. Schakowsky

Co-Sponsor

-

TrackTerri A. Sewell

Co-Sponsor

-

TrackLloyd Smucker

Co-Sponsor

-

TrackEric Sorensen

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackMarilyn Strickland

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

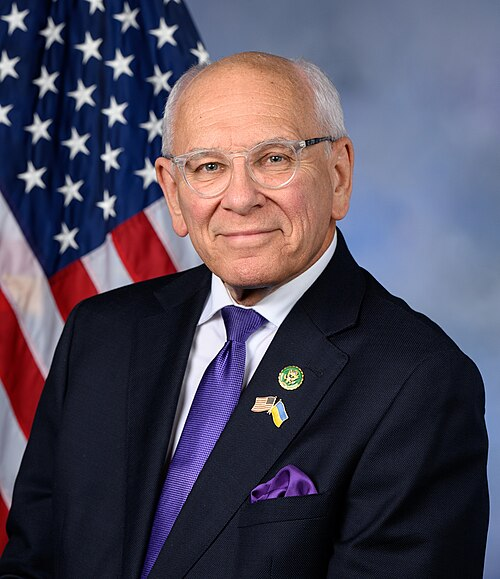

TrackPaul Tonko

Co-Sponsor

-

TrackGabe Vasquez

Co-Sponsor

-

TrackRyan K. Zinke

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in House |

| Apr. 10, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.