H.R. 2841: Putting Trust in Transparency Act

This bill, known as the Putting Trust in Transparency Act, proposes amendments to the Internal Revenue Code aimed at increasing transparency for nongovernmental organizations (NGOs) that receive federal funding. Here are the key components of the bill:

Public Disclosure of Donors

The bill mandates that NGOs which receive federal funding must publicly disclose the names and partial addresses of their contributors. Specifically:

- The Secretary of the Treasury must make public any Schedule B of Form 990 filed by these organizations within 60 days of processing.

- This disclosure should include the names, zip codes, and total contributions of the donors without any redaction.

Loss of Tax-Exempt Status

The bill stipulates that NGOs that fail to submit their Schedule B of Form 990 on time will face consequences:

- The IRS will notify organizations if they have not filed this required form.

- If the organization does not file within 60 days of receiving this notice, it will lose its tax-exempt status.

- The IRS will maintain a public list of organizations whose tax-exempt status has been revoked due to non-compliance.

Oversight and Accountability

The bill emphasizes that any NGO receiving federal funding should be subject to the same oversight as governmental agencies. This is to ensure that taxpayer dollars are used responsibly and transparently.

Timeline for Implementation

The changes described in the bill will apply to tax returns filed for years beginning after the bill's enactment.

Intent of the Bill

The bill's purpose is to provide American citizens with clearer insights into the funding sources of NGOs that receive federal money, promoting transparency regarding how their tax dollars may be utilized by these organizations.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

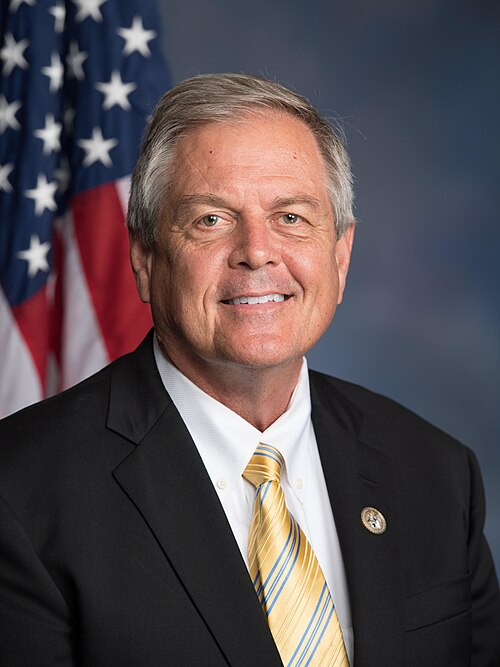

TrackPaul A. Gosar

Sponsor

-

TrackAndy Biggs

Co-Sponsor

-

TrackLauren Boebert

Co-Sponsor

-

TrackJosh Brecheen

Co-Sponsor

-

TrackTim Burchett

Co-Sponsor

-

TrackElijah Crane

Co-Sponsor

-

TrackBrandon Gill

Co-Sponsor

-

TrackAnna Paulina Luna

Co-Sponsor

-

TrackTroy E. Nehls

Co-Sponsor

-

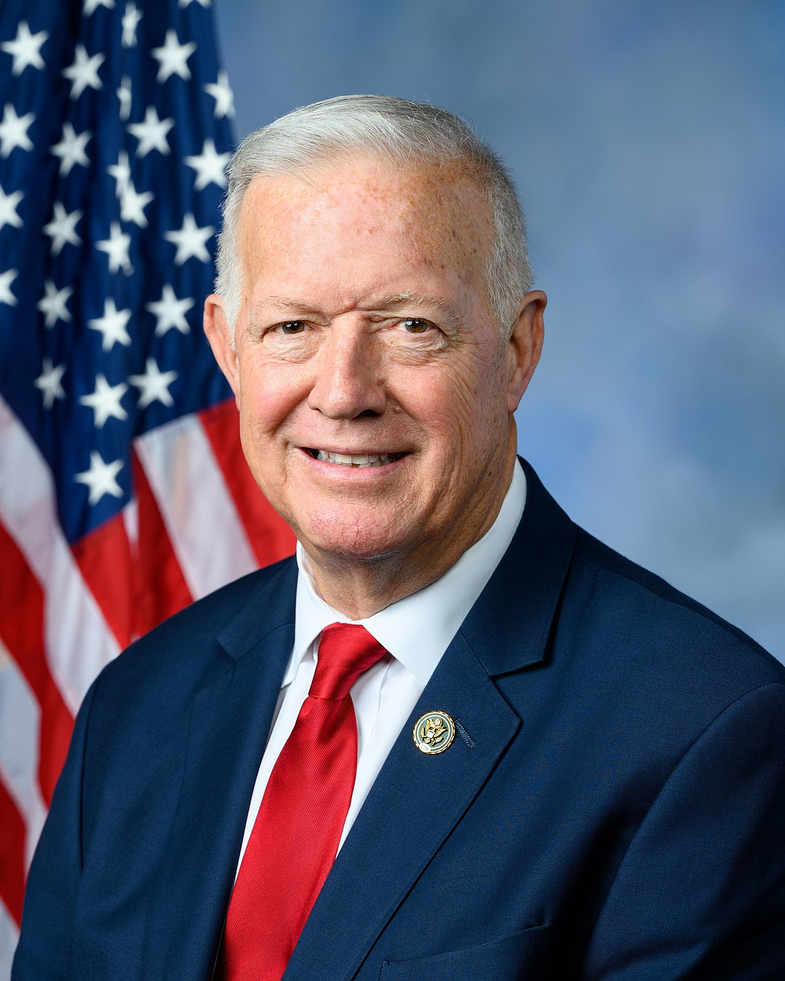

TrackRalph Norman

Co-Sponsor

-

TrackRandy K. Weber, Sr.

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in House |

| Apr. 10, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.