H.R. 2833: Adoption Tax Credit Refundability Act of 2025

This bill, known as the Adoption Tax Credit Refundability Act of 2025, aims to amend the Internal Revenue Code to make the adoption tax credit refundable. Essentially, this means that taxpayers who adopt children could receive a tax credit that is paid out to them even if they do not owe taxes. Here’s a breakdown of the key items in the bill:

1. Refundable Adoption Tax Credit

The bill proposes to move the existing adoption tax credit from one section of the tax code to another, specifically making it part of the refundable credits. This transition allows families who adopt to potentially receive money back from the government if their tax credit exceeds their tax liability.

2. Third-Party Affidavits

The bill also includes a provision regarding the documentation needed to claim the adoption credit. It specifies that standardized affidavits from third parties can be used to verify legal adoptions. This is aimed at simplifying the process for families to claim qualified adoption expenses, particularly those involving special needs children.

3. Effective Date

The changes made by this bill would take effect for taxable years starting after December 31, 2025. This means that the new rules would apply to tax filings for the year 2026 and onwards.

4. Transitional Rule

For families who adopted in the year prior to the changes taking effect, if they had a tax credit from the old adoption tax credit program that exceeded their tax liability, that excess amount would carry forward and be treated as refundable under the new rules when filing taxes in the first year the changes apply.

5. Purpose

The overall intent of the bill is to provide financial relief and support to families who adopt by ensuring they can access benefits that directly alleviate adoption-related costs.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

13 bill sponsors

-

TrackDanny K. Davis

Sponsor

-

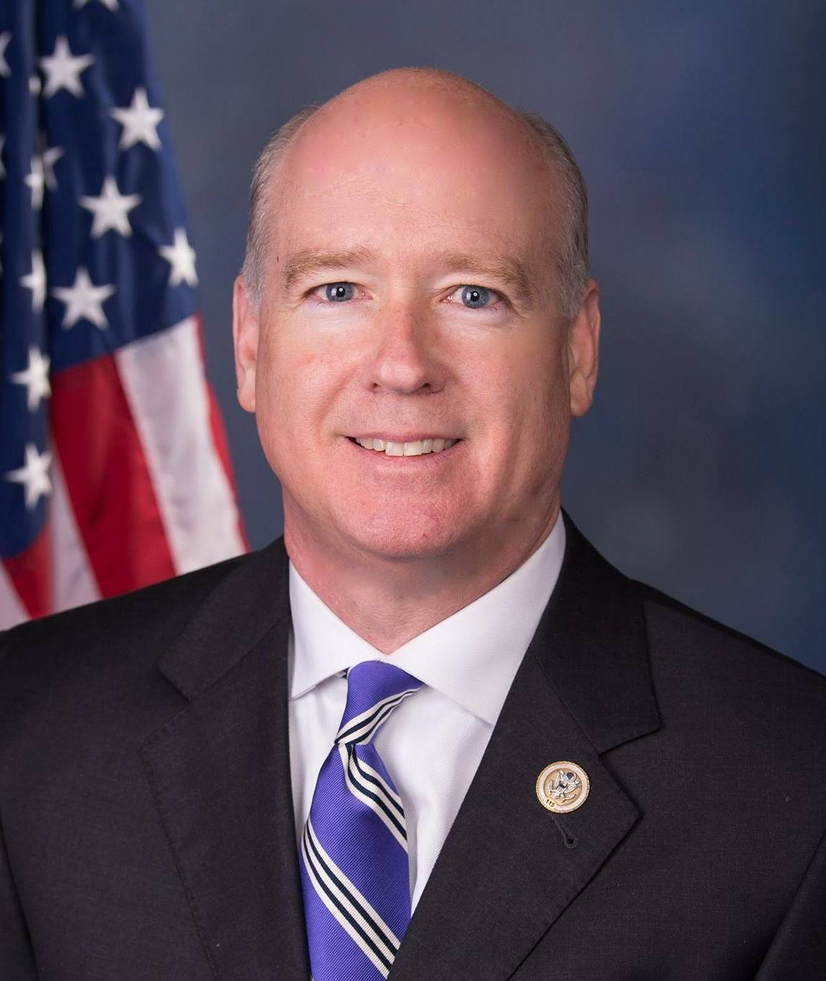

TrackRobert B. Aderholt

Co-Sponsor

-

TrackDon Bacon

Co-Sponsor

-

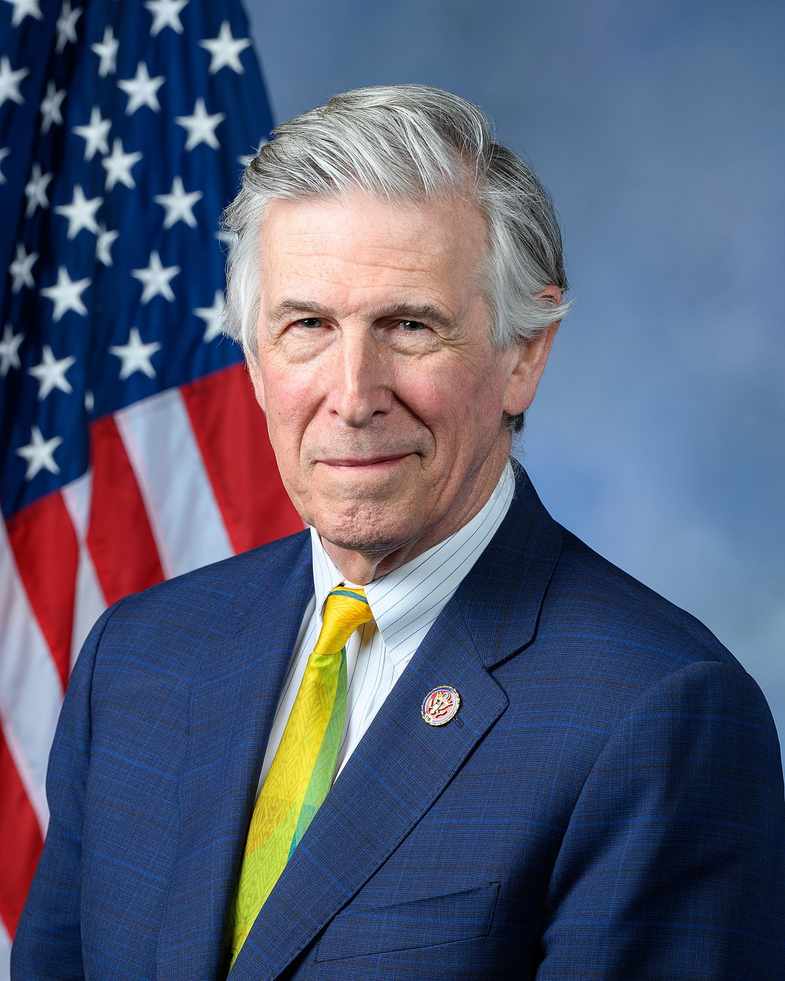

TrackDonald S. Beyer, Jr.

Co-Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackRandy Feenstra

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackSydney Kamlager-Dove

Co-Sponsor

-

TrackBlake D. Moore

Co-Sponsor

-

TrackGwen Moore

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

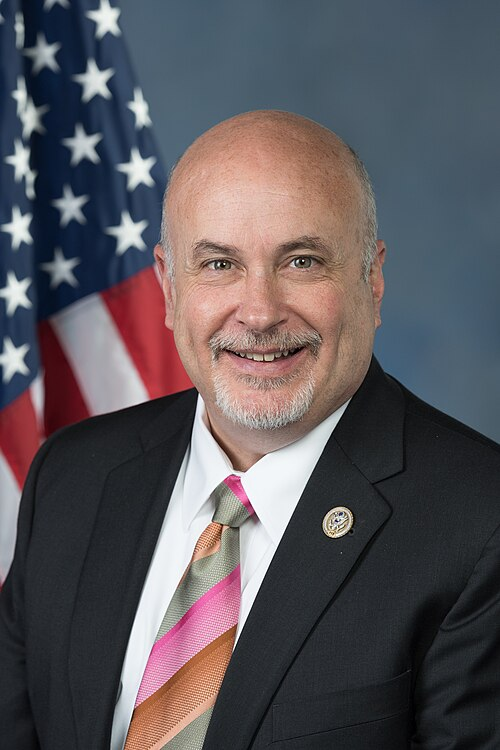

TrackMark Pocan

Co-Sponsor

-

TrackPete Stauber

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in House |

| Apr. 10, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.