H.R. 2814: Transportation Freedom Act

This bill, known as the Transportation Freedom Act, aims to amend the Internal Revenue Code and contain several key provisions related to automobile manufacturing and emissions standards.

1. Support for American Automobile Manufacturing

The bill proposes an enhanced tax deduction for wages paid to workers in the automobile manufacturing sector. Specifically:- **Increased Deduction:** Taxpayers engaged in producing automobiles and automotive components in the U.S. can claim a deduction equal to 200% of eligible wages paid to qualified employees.- **Criteria for Qualifying Employers:** To qualify for this deduction, employers must meet several criteria, including: - A significant portion (at least 75%) of their vehicles must be assembled in the U.S. - At least 75% of certain components (like engines and batteries) must also be produced in the U.S. - They must not have outsourced production of any vehicles or car components outside the U.S. - They must offer comprehensive health coverage to their employees and meet specific pension plan requirements.- **Wage Limits:** The deduction applies only to wages that are at least equal to the 75th percentile of industry wages, with a maximum deductible amount of $150,000 per individual per taxable year.2. Repeal of Multipollutant Emissions Standards

The bill also includes provisions to repeal existing emissions standards:- **Light-duty and Medium-duty Vehicles:** Repeals the EPA's multi-pollutant emissions standards established for model years 2027 and later.- **Heavy-duty Vehicles:** Repeals the EPA's greenhouse gas emissions standards for heavy-duty vehicles, known as Phase 3 standards.- **CAFE Standards:** Removes the Corporate Average Fuel Economy (CAFE) standards applicable to new vehicles for model years 2027 and beyond.3. Emissions Waivers

The legislation seeks to eliminate waivers previously granted under the Clean Air Act that allowed states, like California, to enforce their own stricter emissions standards apart from federal regulations.4. New Federal Standards

The bill mandates new federal greenhouse gas emissions standards and CAFE standards:- **New Passenger Vehicle Standards:** The Secretary of Transportation, alongside other relevant authorities, must set standards for passenger vehicles and light-duty trucks within 180 days of the bill’s enactment. - **Heavy-Duty Vehicle Standards:** Similar standards for heavy-duty vehicles must also be established within the same timeframe. The regulations must consider economic feasibility and technological advancements, while ensuring they do not directly or indirectly mandate electric vehicle production or sales.5. Reporting and Compliance Mechanisms

The Secretary of Transportation and EPA will be required to submit biennial reports to Congress on the progress of achieving set emissions standards. If the new standards are not established by the deadlines defined, the existing standards for model year 2025 will remain effective until new standards are implemented.6. Funding Authorization

The bill authorizes necessary appropriations to implement the measures adopted under its provisions.Relevant Companies

- Ford Motor Company (F): Likely to be impacted due to its significant automotive manufacturing operations in the U.S. and expectations surrounding wage deductions.

- General Motors (GM): May benefit from the enhanced wage deductions for its workers and could see altered compliance requirements due to emissions standards changes.

- Tesla, Inc. (TSLA): As a major player in electric vehicles, its operations may be influenced by the repeal of emissions standards and changes to fuel economy requirements, even while focusing on its distinct emissions profiles.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

17 bill sponsors

-

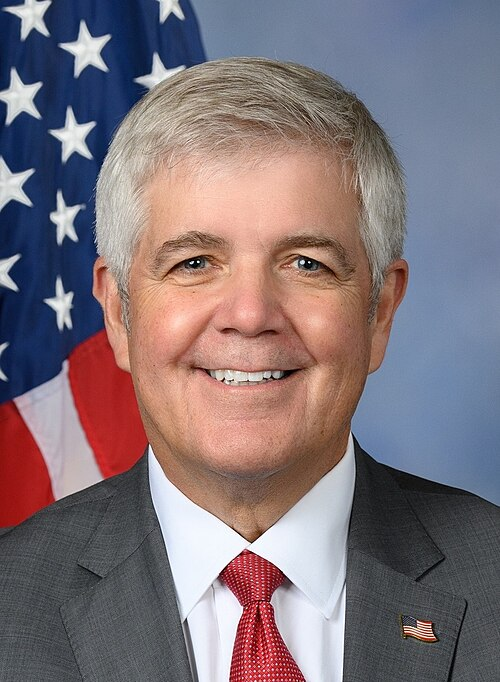

TrackTroy Balderson

Sponsor

-

TrackMark E. Amodei

Co-Sponsor

-

TrackDon Bacon

Co-Sponsor

-

TrackAndy Barr

Co-Sponsor

-

TrackCliff Bentz

Co-Sponsor

-

TrackTom Cole

Co-Sponsor

-

TrackHenry Cuellar

Co-Sponsor

-

TrackScott Franklin

Co-Sponsor

-

TrackLance Gooden

Co-Sponsor

-

TrackJ. French Hill

Co-Sponsor

-

TrackBarry Loudermilk

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

TrackJohn McGuire

Co-Sponsor

-

TrackMary E. Miller

Co-Sponsor

-

TrackBurgess Owens

Co-Sponsor

-

TrackJefferson Van Drew

Co-Sponsor

-

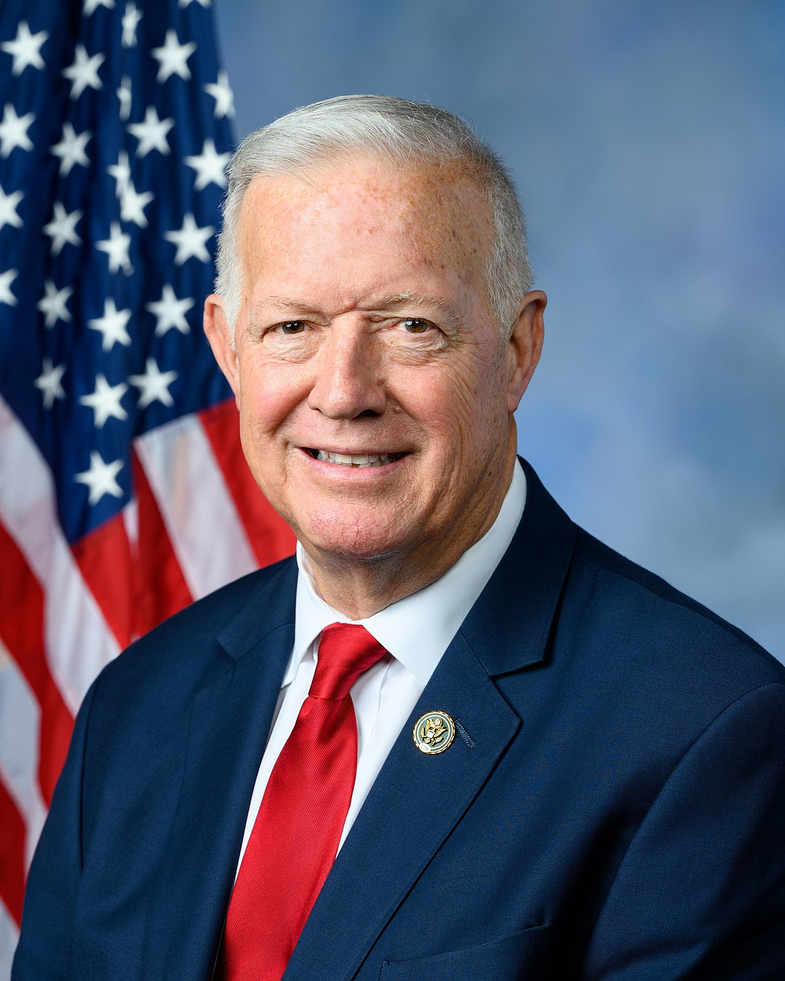

TrackRandy K. Weber, Sr.

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in House |

| Apr. 10, 2025 | Referred to the Committee on Energy and Commerce, and in addition to the Committee on Ways and Means, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.