H.R. 2764: Tax Cut for Workers Act of 2025

This bill, titled the Tax Cut for Workers Act of 2025

, aims to make significant changes to the Earned Income Tax Credit (EITC) as detailed in the Internal Revenue Code. Below are the key elements of the bill:

Permanent Changes to the Earned Income Credit for Individuals without Qualifying Children

- Minimum Age Reduction: The bill proposes to lower the minimum age for individuals to qualify for the EITC from 25 to 19. For students, the age limit is set to 24, while for qualified former foster youths and qualified homeless youths, the age limit is 18.

- Removal of Maximum Age: The bill eliminates the existing maximum age limitation that prevents individuals over age 65 from claiming the EITC.

- Increase in Credit Rates: The percentage of the credit will increase from 7.65% to 15.3% in the calculations involving earned income.

- Increase in Income Limits: The earned income thresholds for claiming the credit will also rise, changing from $4,220 to $9,820, and from $5,280 to $11,610 for single and married individuals, respectively.

Inflation Adjustments

The bill mandates that certain dollar amounts related to the EITC will be adjusted for inflation in future tax years, ensuring that the benefits of the tax credit will keep pace with changes in the cost of living.

Impact on U.S. Territories

- The bill will apply the EITC more broadly to residents of U.S. territories, including Puerto Rico and American Samoa, removing previous limitations that restricted its application to these areas for certain calendar years.

Election to Use Prior Year Earned Income

Taxpayers will have the option to use their prior year's earned income if their current year income is lower. This change is intended to benefit those who may face income fluctuations from year to year, giving them greater stability in the amount of tax credits they can claim.

Effective Date

All amendments and changes proposed in this bill will apply to taxable years beginning after December 31, 2025.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

19 bill sponsors

-

TrackDwight Evans

Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackJasmine Crockett

Co-Sponsor

-

TrackRosa L. DeLauro

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackRo Khanna

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

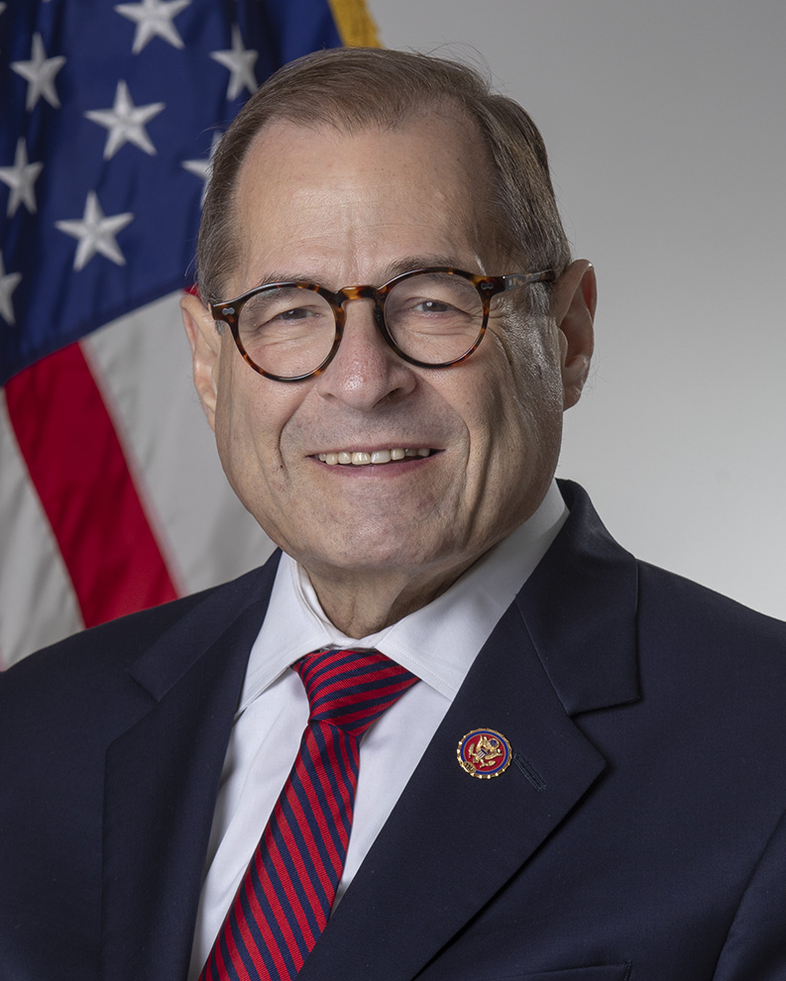

TrackJerrold Nadler

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackAlexandria Ocasio-Cortez

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackMary Gay Scanlon

Co-Sponsor

-

TrackTerri A. Sewell

Co-Sponsor

-

TrackLateefah Simon

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 09, 2025 | Introduced in House |

| Apr. 09, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.