H.R. 2687: End Kidney Deaths Act

This bill, titled the **End Kidney Deaths Act**, proposes changes to the Internal Revenue Code to introduce a refundable tax credit for individuals who make non-directed living kidney donations. Here’s a breakdown of what the bill entails:

Tax Credit for Kidney Donations

The bill establishes a new section in the Internal Revenue Code that allows individuals who make qualified non-directed living kidney donations to receive a tax credit. The key points are:

- Individuals qualifying for this credit can receive a tax credit of **$10,000** for the tax year in which they donate a kidney, as well as for the following four tax years.

- A "qualified non-directed living kidney donation" is defined as a kidney donation where the donor does not know the identity of the recipient at the time of donation.

- The donation must occur while the donor is living and involves the surgical removal of the kidney.

Special Provisions

The bill includes special provisions regarding the tax credit:

- If the donor dies in a tax year for which the credit is allowed, they can claim a credit of up to **$50,000**, minus any credits claimed in previous years.

- The date of donation is established as the date when the kidney is removed from the donor.

Termination of the Credit

The tax credit for non-directed living kidney donations will not be available after **December 31, 2036**.

Additional Amendments

To implement this new credit, the bill makes several conforming amendments to existing tax laws. It also clarifies that the tax credit will not be considered valuable consideration, which aligns with existing regulations prohibiting the purchase of organs.

Effective Date

The provisions of the bill will take effect for kidney donations occurring after **December 31, 2026**.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

38 bill sponsors

-

TrackNicole Malliotakis

Sponsor

-

TrackDon Bacon

Co-Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackStephanie I. Bice

Co-Sponsor

-

TrackRobert Bresnahan

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

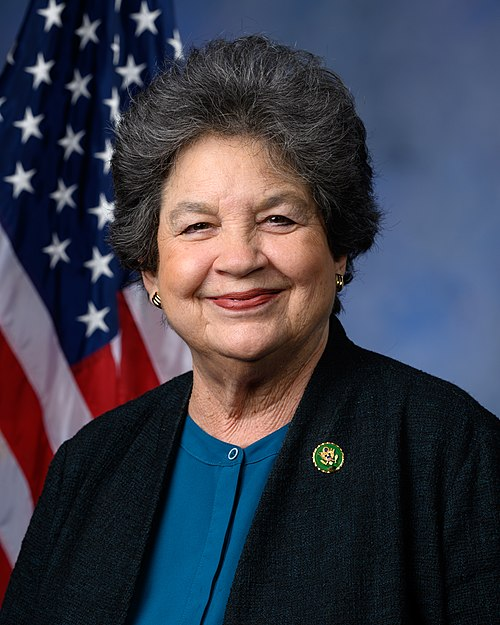

TrackLois Frankel

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackJosh Harder

Co-Sponsor

-

TrackChrissy Houlahan

Co-Sponsor

-

TrackSara Jacobs

Co-Sponsor

-

TrackRo Khanna

Co-Sponsor

-

TrackYoung Kim

Co-Sponsor

-

TrackNick LaLota

Co-Sponsor

-

TrackSam Liccardo

Co-Sponsor

-

TrackBarry Loudermilk

Co-Sponsor

-

TrackCeleste Maloy

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

TrackJared Moskowitz

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

TrackJoe Neguse

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackNancy Pelosi

Co-Sponsor

-

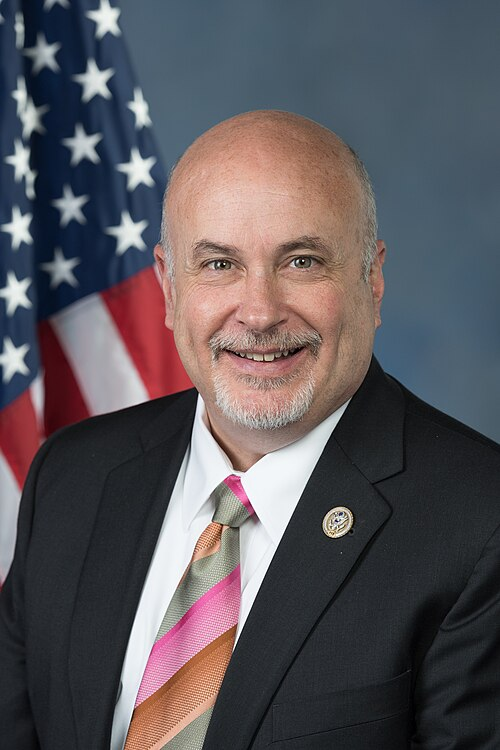

TrackMark Pocan

Co-Sponsor

-

TrackJohn H. Rutherford

Co-Sponsor

-

TrackHillary J. Scholten

Co-Sponsor

-

TrackMelanie A. Stansbury

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

-

TrackDerrick Van Orden

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

TrackDebbie Wasserman Schultz

Co-Sponsor

-

TrackJoe Wilson

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 07, 2025 | Introduced in House |

| Apr. 07, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Energy and Commerce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.