H.R. 2667: Flexible Savings Arrangements for a Healthy Robust America Act

This bill, titled the Flexible Savings Arrangements for a Healthy Robust America Act, proposes amendments to the Internal Revenue Code to facilitate the transfer of funds from health flexible spending arrangements (FSAs) and health reimbursement arrangements (HRAs) directly to health savings accounts (HSAs). Here’s a breakdown of its main components:

Purpose of the Bill

The primary purpose of this bill is to allow individuals to more easily convert or transfer their funds from FSAs and HRAs to HSAs when they enroll in high-deductible health plans (HDHPs). This aims to enhance individuals' ability to use dedicated health savings in a manner that is flexible and useful, particularly for those who experience a change in their health insurance coverage.

Key Provisions

- Qualified HSA Distribution: The bill enables distributions from FSAs or HRAs to be classified as "qualified HSA distributions" if the employee is establishing coverage under a high-deductible health plan after not having coverage for a significant period. This means that these funds can be used to directly fund their HSA.

- Dollar Limitations: The total amount that can be transferred from FSAs and HRAs to HSAs is subject to a dollar limit. This limit is determined based on existing laws regarding employee benefits, ensuring that the total transferred does not exceed specified amounts.

- Partial Reduction of Limitation on HSA Contributions: The bill also allows for a partial reduction in limitations on deductible contributions to HSAs based on any qualified distributions made during the tax year.

- Conversion to HSA-Compatible Arrangements: There are provisions for individuals to have their FSAs or HRAs classified as HSA-compatible for the remainder of the plan year after a qualified distribution is made.

- Reporting Requirements: Employers will need to include information about the amount of any qualified HSA distribution on employees' W-2 forms, ensuring that the amounts are properly tracked and reported for tax purposes.

- Effective Date: The changes proposed by the bill would take effect for distributions made after December 31, 2025, meaning they would apply to tax years ending after this date.

Implications

By allowing these direct transfers, the bill aims to provide more flexibility for employees in managing their healthcare expenses and savings. It is particularly beneficial for those transitioning to high-deductible health plans, as it enables them to maximize their health savings strategies and reduce potential tax burdens associated with multiple accounts.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

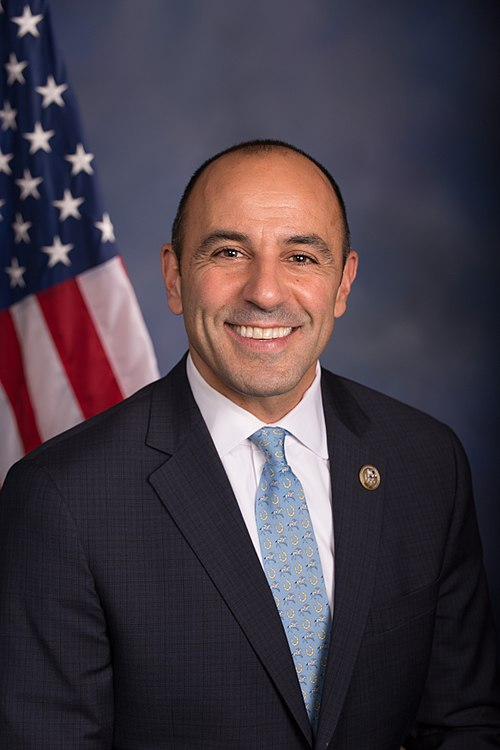

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 07, 2025 | Introduced in House |

| Apr. 07, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.