H.R. 2544: Financial Freedom Act of 2025

This bill, known as the Financial Freedom Act of 2025, aims to modify certain regulations surrounding individual retirement accounts (IRAs) and pension plans. Here are the key points of what the bill proposes:

1. Investment Choices for Participants

The bill seeks to ensure that individuals who have control over their retirement accounts can have a broad range of investment options. Specifically, it proposes that fiduciaries (the individuals or entities managing retirement plans) are not required to limit or favor any particular type of investment alternative for the assets in these accounts. Instead, they must provide participants or beneficiaries the opportunity to choose from various investment alternatives.

2. Self-Directed Brokerage Windows

If a pension plan includes a self-directed brokerage window (a feature allowing participants to invest in a wider array of assets like stocks and bonds), the Secretary of Labor will be prohibited from imposing any regulations that limit the types of investments available through this window. This provision ensures that participants have greater freedom in managing their investments and can leverage various investment options without undue restrictions.

3. Fiduciary Responsibilities

The bill clarifies that fiduciaries should not be held liable for the choice of investment alternatives unless those choices are clearly unsuitable based on their risk-return characteristics. Essentially, it aims to protect fiduciaries from regulatory penalties while still maintaining a focus on the financial appropriateness of the investments offered to participants and beneficiaries.

4. Compliance with Existing Requirements

Even with the introduction of self-directed brokerage windows, the bill assures that fiduciaries will still meet diversification and prudence requirements. This means that fiduciaries must still ensure that investment choices offered in these accounts remain sound and diverse, minimizing the risks associated with any single investment.

5. Overall Intent

The overarching goal of the Financial Freedom Act of 2025 is to enhance the financial freedom of individuals with retirement accounts by expanding their investment choices and reducing regulatory constraints placed on fiduciaries regarding the assets managed within individual accounts.

Relevant Companies

- Vanguard Group (VIG) - As a significant provider of retirement account services, Vanguard could see an increase in account activity and investment options due to the broader freedom provided by the bill.

- BlackRock Inc. (BLK) - BlackRock, another major player in the retirement account space, may be affected by increased competition and changes in investment behavior of self-directed account holders.

- Ameriprise Financial (AMP) - Ameriprise could experience shifts in the types of investment products demanded by consumers in response to the increased flexibility in self-directed brokerage options.

This is an AI-generated summary of the bill text. There may be mistakes.

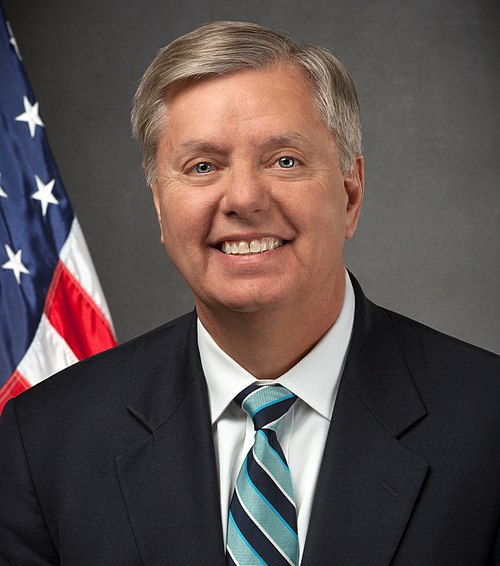

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 01, 2025 | Introduced in House |

| Apr. 01, 2025 | Referred to the House Committee on Education and Workforce. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.