H.R. 2513: Bureau of Consumer Financial Protection-Inspector General Reform Act of 2025

This bill, titled the Bureau of Consumer Financial Protection-Inspector General Reform Act of 2025, aims to reform the appointment and responsibilities of the Inspector General of the Bureau of Consumer Financial Protection (CFPB). Key aspects of the bill include:

Senate Confirmation Requirement

The bill would require that the Inspector General of the CFPB, a position that is currently appointed without Senate confirmation, be subject to confirmation by the Senate. This aims to increase accountability and oversight of the Inspector General's position.

Establishment of the Inspector General Position

The bill formally establishes the position of Inspector General within the CFPB. It specifies that this role has various responsibilities and powers as defined under existing law, including oversight of the CFPB's operations.

Mandatory Reporting and Hearings

Under the proposed legislation, the Inspector General would be required to appear before specific congressional committees on a regular basis. This includes:

- Semiannual hearings before the Senate Committee on Banking, Housing, and Urban Affairs, as well as House committees related to Financial Services and Energy and Commerce.

Funding for the Office of Inspector General

The bill mandates that the CFPB allocate 2% of its transferred funds each fiscal year to the Office of the Inspector General. This aims to ensure dedicated funding for oversight activities within the Bureau.

Participation in Oversight Councils

The bill includes provisions for the CFPB to participate in the Council of Inspectors General on Financial Oversight, which facilitates collaboration among various inspectors general in the financial sector.

Appointment Deadline

The President is required to appoint an Inspector General for the CFPB within 60 days after the bill becomes law. This stipulates a timeline for establishing the role and filling the position.

Effective Date

The changes brought by this bill would take effect upon the Senate confirmation of the first Inspector General of the CFPB. The President may appoint an Inspector General before the amendments take effect.

Transition Provisions

Upon the confirmation of the new Inspector General, the current Inspector General of the Board of Governors of the Federal Reserve System and the CFPB would transition to this new role, ensuring continuity in oversight until the new appointee assumes office.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

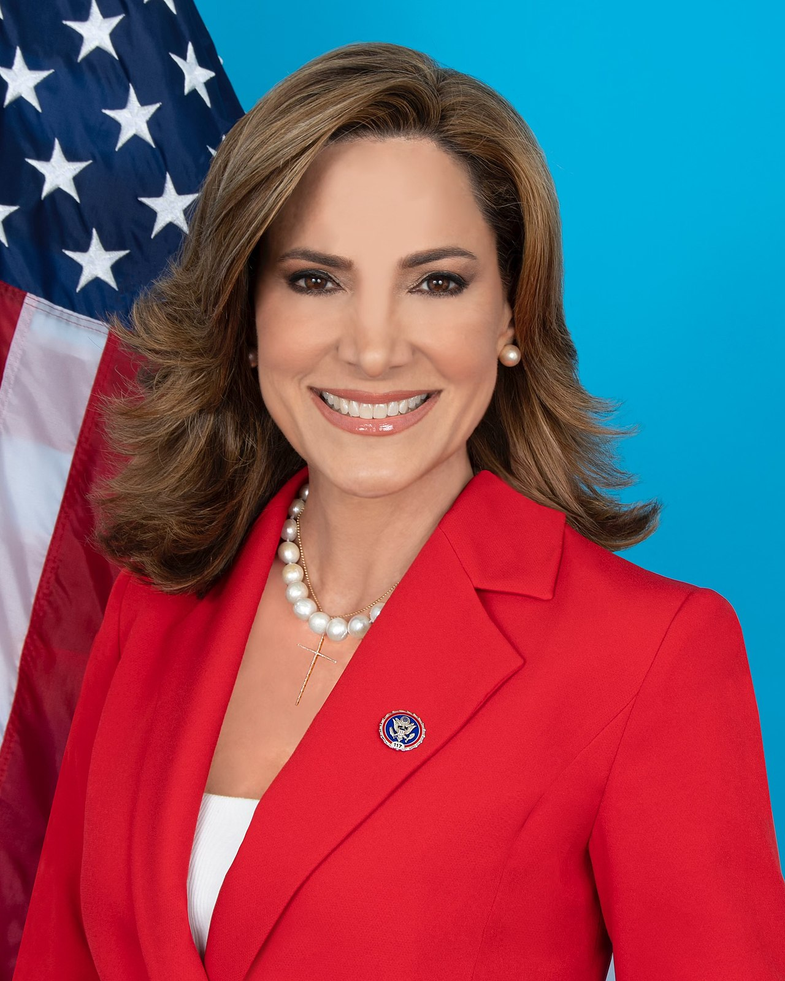

Sponsors

7 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Mar. 31, 2025 | Introduced in House |

| Mar. 31, 2025 | Referred to the Committee on Oversight and Government Reform, and in addition to the Committee on Financial Services, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.