H.R. 2501: Free Speech Fairness Act

This bill, titled the Free Speech Fairness Act

, proposes changes to the Internal Revenue Code, particularly affecting 501(c)(3) organizations, which are typically classified as charitable organizations. The main purpose of this legislation is to allow these organizations to make statements regarding political campaigns without jeopardizing their tax-exempt status.

Key Provisions

The bill would make the following key amendments to the law:

- Political Campaign Statements: It enables 501(c)(3) organizations to make political statements as long as these statements are made during their regular activities while fulfilling their charitable purpose. This means they can discuss or comment on political issues and campaigns without facing penalties related to their tax-exempt status.

- Limit on Expenses: The bill specifies that these political statements should not result in the organization incurring more than a minimal amount of additional expenses. This ensures that any political engagement remains within reasonable cost limits.

- Secures Tax-Exempt Status: The bill reiterates that fulfilling these political speech activities does not constitute participation or intervention in a political campaign for or against candidates, thereby protecting the tax-exempt status of the organization.

Effective Date

The changes proposed by the bill would take effect for taxable years ending after the date the law is enacted.

Implications

By allowing 501(c)(3) organizations to make political statements more freely, the bill aims to enhance their ability to engage in discussions on public issues. This could potentially enable them to influence political discourse while still adhering to their primary charitable missions.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

33 bill sponsors

-

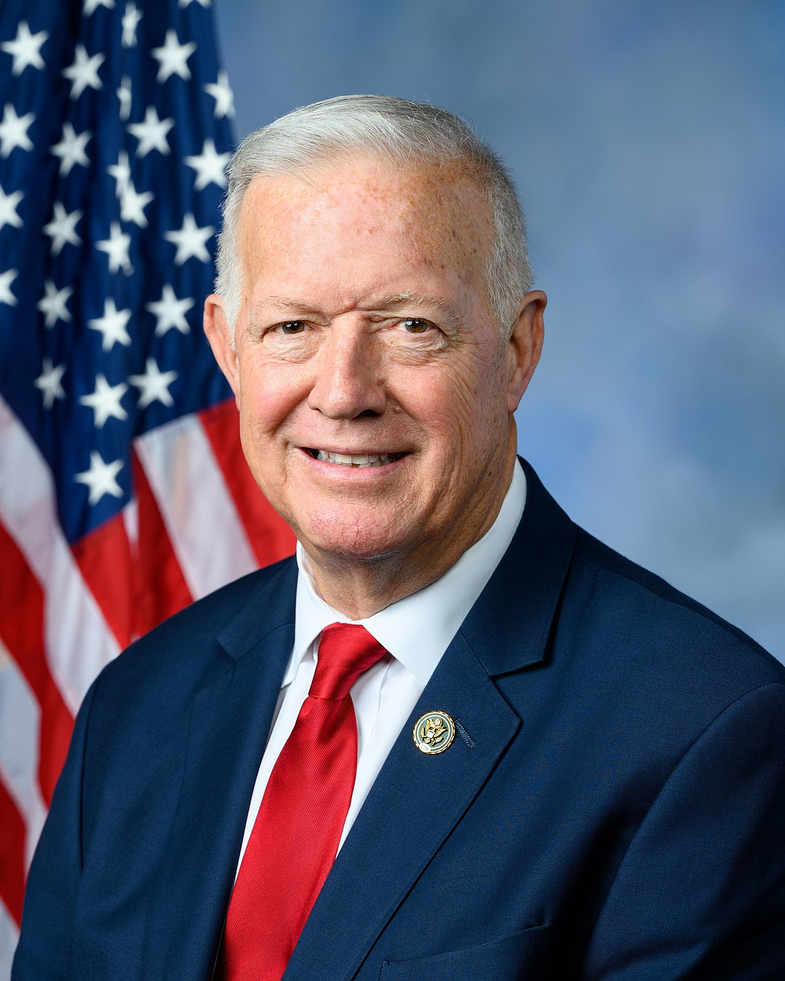

TrackMark Harris

Sponsor

-

TrackRobert B. Aderholt

Co-Sponsor

-

TrackRick W. Allen

Co-Sponsor

-

TrackBrian Babin

Co-Sponsor

-

TrackMichael Baumgartner

Co-Sponsor

-

TrackSheri Biggs

Co-Sponsor

-

TrackJosh Brecheen

Co-Sponsor

-

TrackMichael Cloud

Co-Sponsor

-

TrackAndrew S. Clyde

Co-Sponsor

-

TrackTroy Downing

Co-Sponsor

-

TrackRussell Fry

Co-Sponsor

-

TrackBrandon Gill

Co-Sponsor

-

TrackGlenn Grothman

Co-Sponsor

-

TrackMichael Guest

Co-Sponsor

-

TrackAbraham Hamadeh

Co-Sponsor

-

TrackPat Harrigan

Co-Sponsor

-

TrackAndy Harris

Co-Sponsor

-

TrackDiana Harshbarger

Co-Sponsor

-

TrackClay Higgins

Co-Sponsor

-

TrackDoug LaMalfa

Co-Sponsor

-

TrackJohn McGuire

Co-Sponsor

-

TrackMark Messmer

Co-Sponsor

-

TrackMary E. Miller

Co-Sponsor

-

TrackRiley Moore

Co-Sponsor

-

TrackBarry Moore

Co-Sponsor

-

TrackAndrew Ogles

Co-Sponsor

-

TrackDavid Rouzer

Co-Sponsor

-

TrackKeith Self

Co-Sponsor

-

TrackW. Gregory Steube

Co-Sponsor

-

TrackMarlin A. Stutzman

Co-Sponsor

-

TrackTim Walberg

Co-Sponsor

-

TrackRandy K. Weber, Sr.

Co-Sponsor

-

TrackJoe Wilson

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Mar. 31, 2025 | Introduced in House |

| Mar. 31, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.