H.R. 2338: Worker Relief and Credit Reform Act of 2025

Summary of the Bill

The bill, titled the Worker Relief and Credit Reform Act of 2025, aims to amend the Internal Revenue Code to expand and improve the Earned Income Tax Credit (EITC) for individuals, particularly focusing on students and caregivers. Here’s a breakdown of the key points addressed in the bill:

1. Expansion of Earned Income Tax Credit

The bill proposes to:

- Include Students: Allow qualifying students, specifically those receiving Federal Pell Grants, to be eligible for the EITC, which was not previously allowed.

- Adjust Age Requirements: Lower the minimum age to qualify for the EITC from 25 to 18 years.

- Recognize Care-Giving and Learning: Treat individuals who are qualifying students or caregivers as having earned income, thus increasing their potential eligibility for the EITC.

2. Changes to Definitions and Qualifications

The bill modifies definitions regarding dependents and qualifying students:

- Qualifying Relatives: Broaden the definition of qualifying dependents to include more individuals who may require support, like those who are physically or mentally incapable of self-care.

- Household Income Threshold: Set the income thresholds for qualifying students and independent students at 300% of the poverty line for their family size.

3. Adjustments to Credit Amounts

The bill specifies changes to the credit and phaseout amounts:

- Earned Income Amount: Establish an earned income amount of $4,000 ($8,000 for joint returns).

- Phaseout Amount: Set phaseout amounts at $30,000 ($50,000 for joint returns).

4. Increase for Unmarried Individuals with Children

For unmarried individuals with two or more qualifying children, the bill proposes an increased credit percentage. Specifically:

- An increase to 12.5% for two qualifying children and 18.75% for individuals with three or more qualifying children.

5. Advance Payment Program

The bill establishes a program for advance payments of the EITC:

- Monthly Payments: Allows direct monthly payments of up to 75% of an estimated earned income credit.

- Payment Options: Offers payment methods including prepaid debit cards.

6. Educational Outreach

A program will be initiated to educate the public about the EITC and the new advance payment program through:

- Providing written notices to taxpayers likely to qualify.

- Workshops held at IRS district offices.

- Quarterly reminders to participating taxpayers.

7. Effective Date

The provisions of this bill would apply to taxable years beginning after December 31, 2024.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

13 bill sponsors

-

TrackGwen Moore

Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

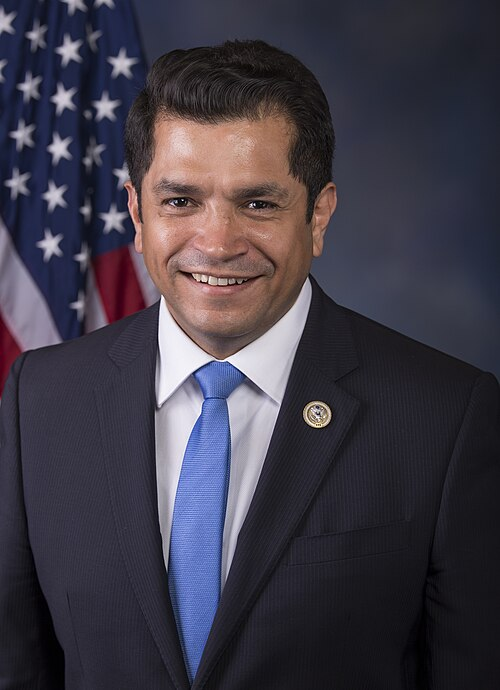

TrackJimmy Gomez

Co-Sponsor

-

TrackPramila Jayapal

Co-Sponsor

-

TrackRo Khanna

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackIlhan Omar

Co-Sponsor

-

TrackChellie Pingree

Co-Sponsor

-

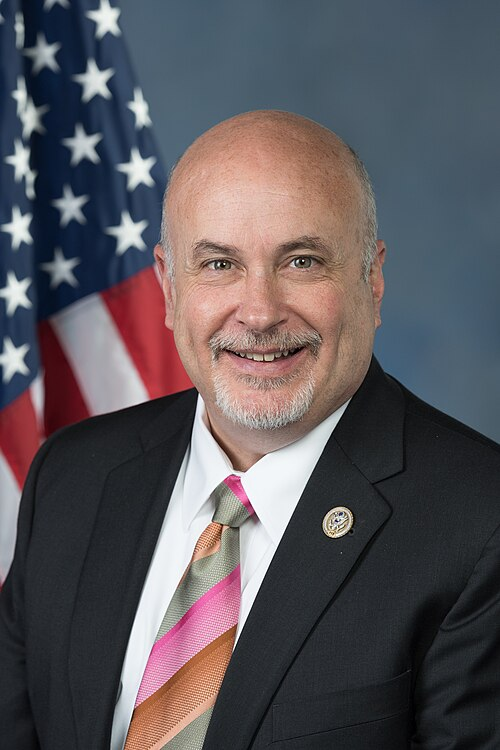

TrackMark Pocan

Co-Sponsor

-

TrackMary Gay Scanlon

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Mar. 25, 2025 | Introduced in House |

| Mar. 25, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.