H.R. 2299: Ensuring Workers Get PAID Act of 2025

The **Ensuring Workers Get PAID Act of 2025** aims to establish a new program called the **Payroll Audit Independent Determination (PAID)** program within the Department of Labor. This program is designed to help employers who inadvertently violate wage laws to voluntarily correct their mistakes, particularly related to unpaid minimum wages or overtime compensation as per the Fair Labor Standards Act of 1938.

Key Aspects of the PAID Program

- Program Goals: The program intends to provide a collaborative environment where employers can resolve wage violations swiftly without facing severe penalties.

- Application Process: Employers interested in participating must submit an application that details any identified violations from a self-audit, including information about affected employees and the calculations for unpaid wages.

- Resources for Employers: The Department of Labor is required to disseminate compliance resources to assist employers in understanding and fulfilling wage and hour requirements.

Audit and Settlement Procedures

- Self-Audits: Employers must conduct self-audits to identify violations and provide thorough documentation in their application for the program.

- Review Process: The applications will be reviewed by the Administrator of the Wage and Hour Division. They may consult with employers to clarify details during the review process.

- Approval Conditions: Applications can be approved if the self-audit is accurate, and the employer has not been found to violate wage laws in the last five years. Employers are also required to demonstrate good faith in correcting the identified violations.

- Settlement Process: If an application is approved, the employer receives a summary of owed wages and potential claims releases for employees. It also issues release forms to affected employees, enabling them to accept or decline the settlement offer.

Employee Protections

- Right to Decline: Employees can choose to decline the settlement offer and retain their right to pursue private legal action for unpaid wages.

- Protection from Retaliation: The bill expands protections against retaliation for employees who accept or decline settlement offers under this program.

Program Limitations and Protections for Employers

- Non-Disclosure of Information: Any information shared by employers in their applications will not be used against them in future investigations or legal proceedings, ensuring employers can participate without fear of punitive repercussions.

- No Fees for Participation: Employers will not be charged any fees to apply for or participate in the program.

Implementation Timeline

The Administrator is required to make resources available to employers within 30 days after the enactment of the Act, facilitating immediate access to compliance information.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

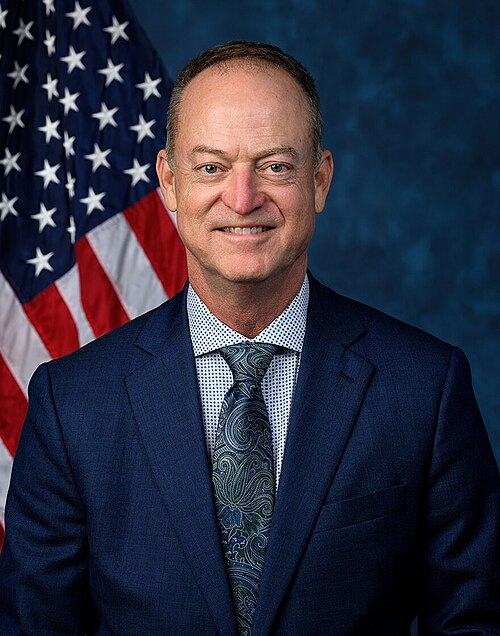

Sponsors

6 bill sponsors

Actions

4 actions

| Date | Action |

|---|---|

| Nov. 20, 2025 | Committee Consideration and Mark-up Session Held |

| Nov. 20, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 20 - 15. |

| Mar. 24, 2025 | Introduced in House |

| Mar. 24, 2025 | Referred to the House Committee on Education and Workforce. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.