H.R. 2225: Access to Small Business Investor Capital Act

This bill, known as the Access to Small Business Investor Capital Act, aims to modify how certain fees are reported by registered investment companies to the Securities and Exchange Commission (SEC). Below are the key components of what the bill would do:

Definitions

- Acquired Fund: Refers to funds as defined in specific SEC forms (N–1A, N–2, N–3).

- Acquired Fund Fees and Expenses: These are fees associated with the acquired funds, which include various costs disclosed in investment company documentation.

- Business Development Company: A type of company designed to support small and emerging businesses, as defined under the Investment Company Act of 1940.

- Fee Table Disclosure: This is the table where the fees and expenses for investment funds are summarized in regulatory filings.

- Registered Investment Company: This is a company that invests in securities and is registered with the SEC.

Modification of Fee Reporting Requirements

The key change proposed by this bill is that registered investment companies would be allowed to exclude from their calculations of Acquired Fund Fees and Expenses the fees and expenses incurred indirectly due to their investments in shares of business development companies. This means that when investment companies report their fees, they will not have to count certain costs associated with these business development investments.

Implications

This change is intended to streamline the reporting process for registered investment companies, potentially making it easier and less costly for them to comply with SEC requirements. It could also highlight the investment companies' focus on investing in smaller, growing businesses, which may support capital investment in that sector.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

26 bill sponsors

-

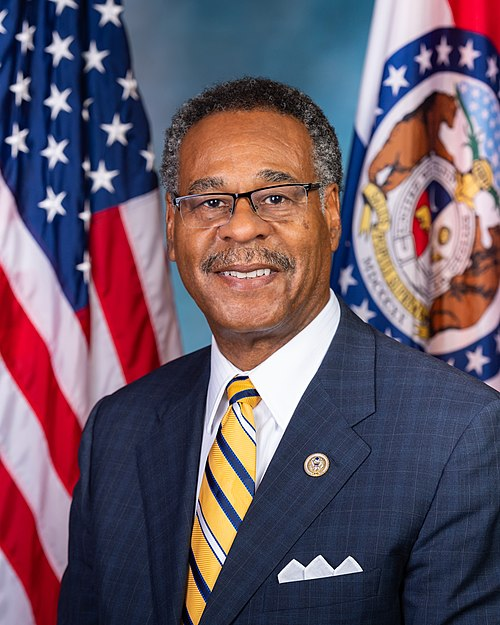

TrackBrad Sherman

Sponsor

-

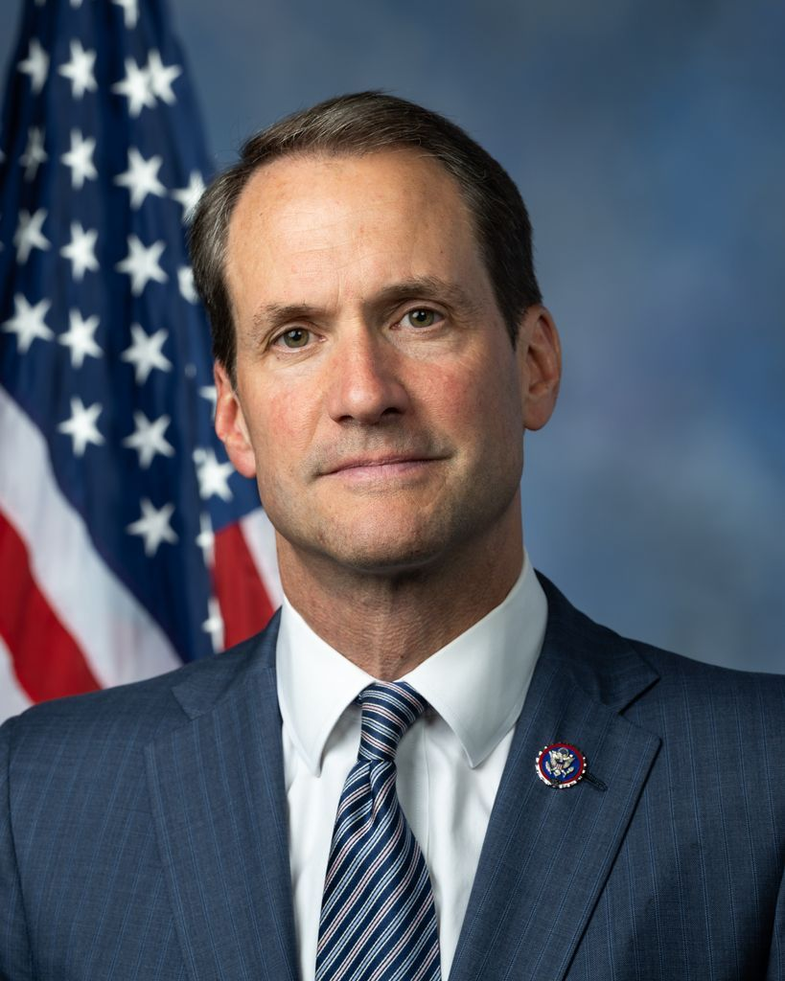

TrackAndy Barr

Co-Sponsor

-

TrackBrendan F. Boyle

Co-Sponsor

-

TrackJanelle Bynum

Co-Sponsor

-

TrackSean Casten

Co-Sponsor

-

TrackEmanuel Cleaver

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackBill Foster

Co-Sponsor

-

TrackAndrew R. Garbarino

Co-Sponsor

-

TrackVicente Gonzalez

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackJames A. Himes

Co-Sponsor

-

TrackBill Huizenga

Co-Sponsor

-

TrackYoung Kim

Co-Sponsor

-

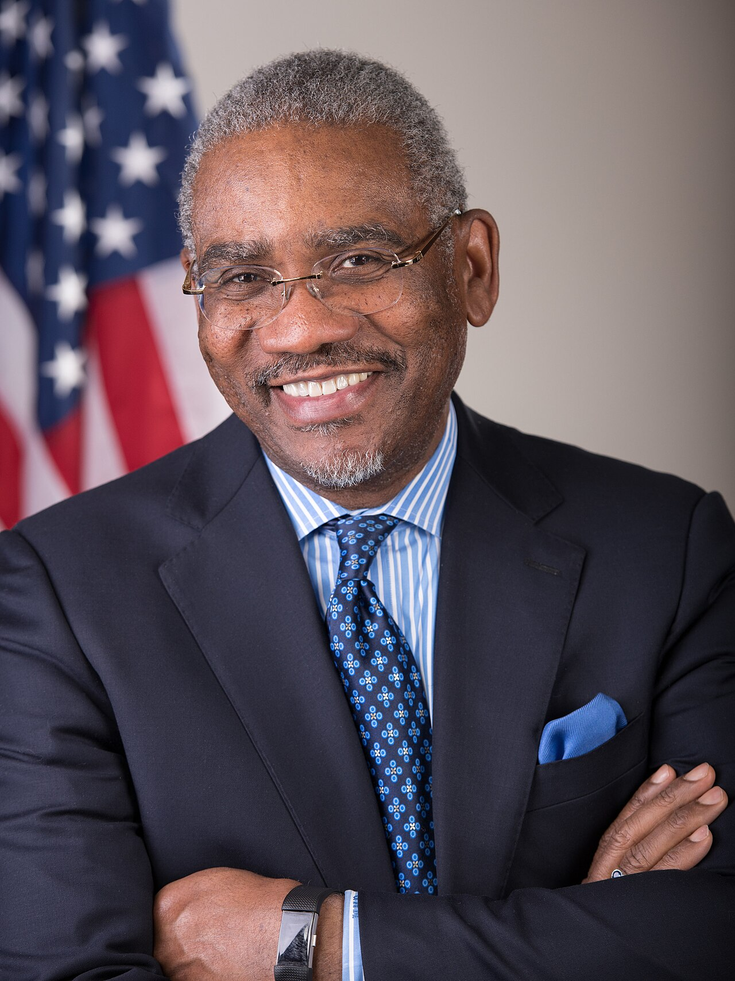

TrackGregory W. Meeks

Co-Sponsor

-

TrackGrace Meng

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackZachary Nunn

Co-Sponsor

-

TrackBrittany Pettersen

Co-Sponsor

-

TrackDavid Scott

Co-Sponsor

-

TrackBryan Steil

Co-Sponsor

-

TrackMarilyn Strickland

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

-

TrackNydia M. Velázquez

Co-Sponsor

-

TrackAnn Wagner

Co-Sponsor

Actions

13 actions

| Date | Action |

|---|---|

| Jun. 24, 2025 | Received in the Senate and Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

| Jun. 23, 2025 | Considered under suspension of the rules. (consideration: CR H2868-2869) |

| Jun. 23, 2025 | DEBATE - The House proceeded with forty minutes of debate on H.R. 2225. |

| Jun. 23, 2025 | Motion to reconsider laid on the table Agreed to without objection. |

| Jun. 23, 2025 | Mrs. Wagner moved to suspend the rules and pass the bill, as amended. |

| Jun. 23, 2025 | On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. (text: CR H2868) |

| Jun. 23, 2025 | Passed/agreed to in House: On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. (text: CR H2868) |

| Jun. 03, 2025 | Placed on the Union Calendar, Calendar No. 96. |

| Jun. 03, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-126. |

| May. 20, 2025 | Committee Consideration and Mark-up Session Held |

| May. 20, 2025 | Ordered to be Reported (Amended) by Voice Vote. |

| Mar. 18, 2025 | Introduced in House |

| Mar. 18, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

4 companies lobbying