H.R. 206: Landlord Accountability Act of 2025

This bill, known as the Landlord Accountability Act of 2025, seeks to update the Fair Housing Act to enhance protections against rental discrimination, particularly concerning individuals who utilize housing assistance vouchers, such as those from the Section 8 program. Here’s a breakdown of its key provisions:

Prohibiting Discrimination Based on Source of Income

The bill intends to make it illegal for landlords to discriminate against tenants based on their source of income. This includes:

- Current and future use of housing vouchers, specifically Section 8 vouchers.

- Any form of housing assistance (Federal, State, or local), including rental assistance and homeownership subsidies.

- Income from social security, disability benefits, child support, or other court-ordered payments.

- Any other source of income, including savings or investments.

Enforcement and Support

The bill allocates significant funding to strengthen enforcement of fair housing laws:

- Proposes $90 million for the Fair Housing Initiatives Program and $47 million for Fair Housing Assistance Programs annually through fiscal years 2026 to 2035.

- Authorizes $3 million annually for a national media campaign aimed at raising awareness about tenant rights and how to report discrimination.

- Mandates increased staffing for HUD's complaint line to handle inquiries and complaints effectively.

Penalties Against Landlords

Under this bill, landlords face new penalties for misconduct:

- Landlords cannot deliberately create uninhabitable conditions in their properties to disqualify them from federal assistance programs.

- Violations can result in civil penalties of up to $100,000 per incident.

- Tenants may seek damages, including $50,000 for each violation plus any actual damages incurred.

Vacancy Penalties

If a rental unit that is subsidized is intentionally kept vacant for more than 60 days, the landlord may be penalized $100,000 for each 30-day period it remains vacant, encouraging landlords to rent out available housing.

Public Awareness and Tenant Resources

Landlords of qualifying properties must display information prominently about tenant rights and complaint resources, including language options to ensure understanding among diverse tenants.

Tenant Harassment Programs

The bill allows for the development and funding of tenant harassment prevention programs. Grants may be made to various entities to assist in protecting tenants from illegal harassment by landlords.

Tax Credits for Landlords

A new tax credit for landlords maintaining low-income housing will be established to incentivize compliance with tenant rights and improve property conditions. This credit can help cover maintenance expenses associated with properties occupied by tenants using rental vouchers.

Definitions and Regulations

The bill includes definitions for key terms such as “multifamily housing project,” “rental assistance voucher,” and “voucher user,” allowing the Secretary of Housing and Urban Development to create necessary regulations to implement the act.

Relevant Companies

- AIV (Apartment Investment and Management Company): As a property management company with a focus on multifamily housing, changes in legal provisions regarding tenant protections might affect their leasing processes and operational compliance.

- ESS (Essex Property Trust): A real estate investment trust that might see implications on how they manage properties occupied by tenants utilizing government housing vouchers.

This is an AI-generated summary of the bill text. There may be mistakes.

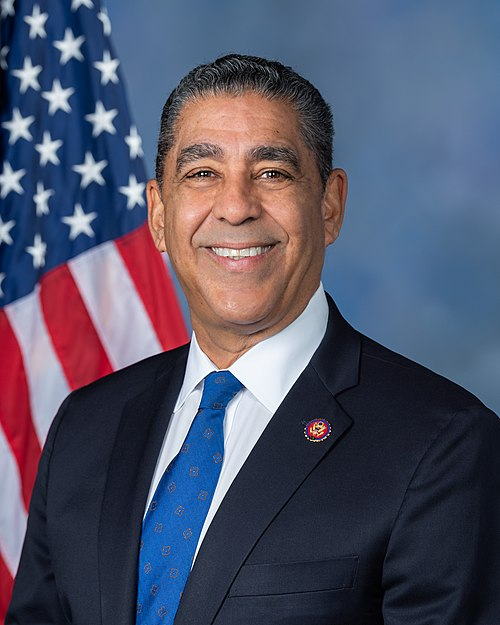

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 03, 2025 | Introduced in House |

| Jan. 03, 2025 | Referred to the Committee on Financial Services, and in addition to the Committees on Ways and Means, and the Judiciary, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.