H.R. 1745: Humans over Private Equity for Homeownership Act

This bill, known as the Humans over Private Equity for Homeownership Act, aims to address issues related to hedge funds acquiring and holding excessive numbers of single-family residences. The main provisions of the bill can be summarized as follows:

Excise Tax on Hedge Funds

The bill proposes introducing an excise tax that would apply to hedge funds that fail to sell off excess single-family homes. This tax structure is designed to discourage hedge funds from owning more homes than allowed, thereby promoting market availability for individual buyers. Specific components include:

- Acquisition Tax: Hedge funds acquiring newly purchased single-family residences would incur a tax based on either 15% of the purchase price or a flat fee of $10,000, whichever is greater.

- Excess Ownership Tax: If hedge funds own more single-family residences than allowed (termed "excess single-family residences"), they would be subject to an additional tax of $5,000 plus a charge based on the excess number of homes owned over a set limit.

Definitions and Criteria

The bill outlines several key definitions and criteria:

- Applicable Taxpayer: This includes any hedge fund with at least $50 million in net value or assets under management.

- Single-Family Residence: Defined as a property with 1-4 dwelling units. Special exceptions apply to homes acquired through foreclosure under specific conditions.

- Maximum Permissible Units: This refers to the limit on how many residences a hedge fund can own, which decreases over a period of years to encourage divestment.

Disallowance of Certain Deductions

The bill also proposes the disallowance of tax deductions for mortgage interest and property depreciation for those owning single-family residences if they are subject to the excise tax mentioned above. This measure aims to further dissuade excessive ownership by hedge funds.

Timeline and Effective Date

The proposed amendments and regulations would take effect for taxable years commencing after the bill's enactment. This means hedge funds will need to comply with the new rules and tax structures in their subsequent fiscal planning.

Relevant Companies

- AMH (American Homes 4 Rent) - As a company involved in owning and managing single-family rental properties, any tax implications on excessive ownership could affect their operational costs and strategies.

- INVH (Invitation Homes) - This company, which is one of the largest owners of single-family rental homes, could be directly impacted by taxes on excess home ownership, potentially altering their acquisition strategies.

- Z (Zillow) - As a major player in real estate, changes in home ownership dynamics from hedge fund regulations might influence Zillow’s market data and forecasting.

- EXR (Extra Space Storage) - Their operations might be indirectly affected if changes in homeownership drive demand or supply shifts in storage needs.

This is an AI-generated summary of the bill text. There may be mistakes.

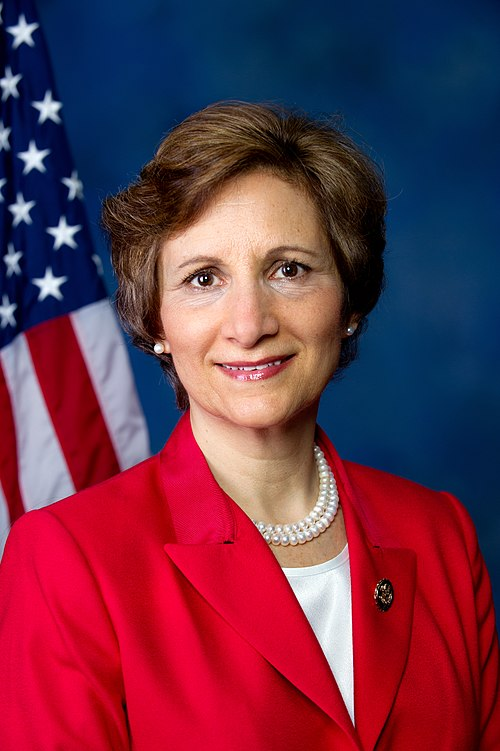

Sponsors

6 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 27, 2025 | Introduced in House |

| Feb. 27, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.