H.R. 174: Consequences for Social Security Fraud Act

This bill, titled the "Consequences for Social Security Fraud Act," aims to amend existing immigration laws with respect to individuals who commit Social Security fraud. Here’s a breakdown of what the bill would do:

Inadmissibility and Deportability

The bill introduces two main legal changes regarding the status of aliens (non-citizens) who commit certain types of fraud:

- Inadmissibility: The bill would make any alien who has been convicted of, or who admits to committing, Social Security fraud or fraud involving identification documents ineligible to enter the United States. This includes crimes related to:

- Social Security account numbers or cards under the Social Security Act.

- Fraud involving identification documents under federal law.

- Participation in conspiracies to commit the above offenses.

- Deportability: It would also classify these same individuals as deportable if they are found within the United States. That is, individuals who have been convicted or admitted committing these offenses could be removed from the country.

Covered Offenses

The bill specifically mentions the nature of crimes it covers, which include:

- Fraud related to loans or grants issued under the Small Business Act or the American Rescue Plan Act in the context of the COVID-19 pandemic.

- Fraud related to specific sections of the Social Security Act.

- Fraud involving identification documents or information.

This means that not only general Social Security fraud is addressed but also fraud that may have been committed during federal responses to the COVID-19 pandemic, as individuals sought financial assistance through various programs.

Implementation

The bill is proposed to be referred to the House Judiciary Committee for further consideration. If passed, it would change the immigration laws leading to stricter repercussions for non-citizens involved in Social Security fraud or related offenses.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

18 bill sponsors

-

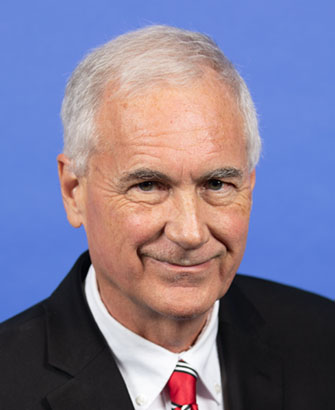

TrackTom McClintock

Sponsor

-

TrackJosh Brecheen

Co-Sponsor

-

TrackJeff Crank

Co-Sponsor

-

TrackChuck Edwards

Co-Sponsor

-

TrackGlenn Grothman

Co-Sponsor

-

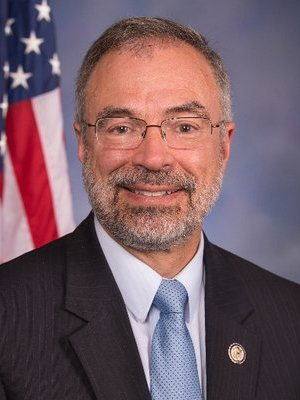

TrackAndy Harris

Co-Sponsor

-

TrackErin Houchin

Co-Sponsor

-

TrackWesley Hunt

Co-Sponsor

-

TrackDoug LaMalfa

Co-Sponsor

-

TrackJay Obernolte

Co-Sponsor

-

TrackBurgess Owens

Co-Sponsor

-

TrackHarold Rogers

Co-Sponsor

-

TrackKeith Self

Co-Sponsor

-

TrackAdrian Smith

Co-Sponsor

-

TrackPete Stauber

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

TrackAnn Wagner

Co-Sponsor

-

TrackJoe Wilson

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 03, 2025 | Introduced in House |

| Jan. 03, 2025 | Referred to the House Committee on the Judiciary. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.