H.R. 1611: Respect, Advancement, and Increasing Support for Educators Act of 2025

This bill, known as the Respect, Advancement, and Increasing Support for Educators Act of 2025 (RAISE Act of 2025), proposes several measures aimed at financially supporting teachers and improving education. Below are the key components of the bill:

1. Refundable Teacher Tax Credit

The bill introduces a refundable tax credit for eligible educators. Here are the main features:

- Credit Amount: Eligible educators would receive a tax credit of $1,000 plus additional amounts based on their school's student poverty ratio. This could reach a maximum of $14,000, but would reduce to $9,000 for early childhood educators without a bachelor's degree.

- Eligibility: The credit applies to elementary, secondary, and early childhood educators who meet specific employment and certification requirements.

- Qualifying Schools: The tax credit is targeted at educators working in public schools or qualifying early childhood programs with high poverty student ratios.

2. Increase in Teacher Expense Deduction

The bill proposes to double the existing deduction teachers can claim for out-of-pocket classroom expenses from $250 to $500. This deduction will also be adjusted for inflation in future years and will be expanded to include early childhood educators as well.

3. Mandatory Funding for Teacher Salaries

The bill establishes mandatory funding to support local educational agencies that maintain or increase teacher salaries. Key points include:

- Authorization of $5.2 billion for 2026, with annual increases based on the Consumer Price Index thereafter.

- A focus on grants for local agencies that demonstrate they are maintaining or increasing teachers' salary schedules.

4. Provisions for Teacher Rights and Protections

The legislation specifies protections for educators in relation to collective bargaining. These include:

- Employers cannot use the tax credit in salary negotiations or change work assignments to prevent educators from receiving the credit.

- Enforcement mechanisms through the Federal Labor Relations Authority to address any violations.

5. Data Collection and Compliance

The Secretary of Education is tasked with collecting data necessary to determine which schools qualify for the tax credit. Additionally, qualifying schools must comply with information requests to secure federal funds.

6. Effective Date

The provisions of the bill will take effect for taxable years starting after its enactment.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

53 bill sponsors

-

TrackJahana Hayes

Sponsor

-

TrackAlma S. Adams

Co-Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackSanford D. Bishop, Jr.

Co-Sponsor

-

TrackShontel M. Brown

Co-Sponsor

-

TrackNikki Budzinski

Co-Sponsor

-

TrackJanelle Bynum

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackSheila Cherfilus-McCormick

Co-Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackMark DeSaulnier

Co-Sponsor

-

TrackSuzan K. DelBene

Co-Sponsor

-

TrackSarah Elfreth

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackLizzie Fletcher

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

TrackLaura Friedman

Co-Sponsor

-

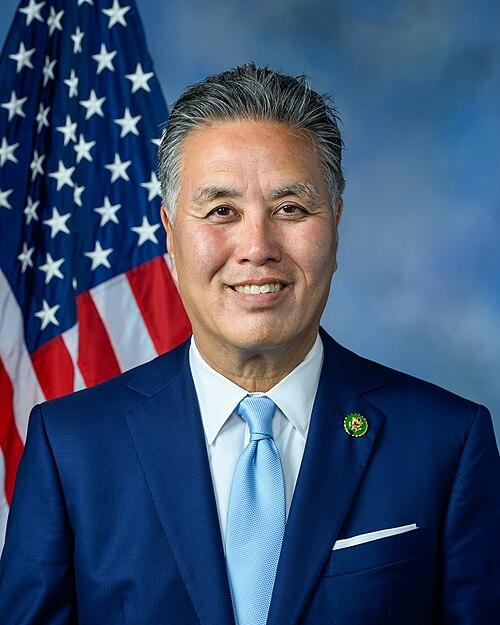

TrackRobert Garcia

Co-Sponsor

-

TrackSylvia R. Garcia

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackJulie Johnson

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackJohn B. Larson

Co-Sponsor

-

TrackGeorge Latimer

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackStephen F. Lynch

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackJohn Mannion

Co-Sponsor

-

TrackLucy McBath

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

TrackJennifer L. McClellan

Co-Sponsor

-

TrackBetty McCollum

Co-Sponsor

-

TrackMorgan McGarvey

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackLaMonica McIver

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

TrackJerrold Nadler

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackAlexandria Ocasio-Cortez

Co-Sponsor

-

TrackMark Pocan

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackMary Gay Scanlon

Co-Sponsor

-

TrackJanice D. Schakowsky

Co-Sponsor

-

TrackMelanie A. Stansbury

Co-Sponsor

-

TrackMark Takano

Co-Sponsor

-

TrackBennie G. Thompson

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

-

TrackLori Trahan

Co-Sponsor

-

TrackGeorge Whitesides

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 26, 2025 | Introduced in House |

| Feb. 26, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Education and Workforce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.