H.R. 1496: Rare Earth Magnet Security Act of 2025

This bill, known as the Rare Earth Magnet Security Act of 2025

, proposes changes to the United States tax code to encourage domestic production of high-performance rare earth magnets. Here’s a breakdown of its main components:

Production Tax Credit

The bill introduces a new tax credit for manufacturers of rare earth magnets. This credit is intended to provide financial incentives for companies that produce these magnets in the United States. Specifically:

- A company can earn a credit of **$20 per kilogram** for magnets manufactured domestically.

- If at least **90% of the materials** used in the magnet's production are sourced from within the U.S., the credit increases to **$30 per kilogram**.

Sales Requirements

For a company to claim the tax credit, the rare earth magnets must be sold to unrelated persons

, which typically means customers that are not affiliated with the manufacturer. However, there is a provision allowing companies to sell to related persons and still claim the credit if they elect to do so, ensuring some flexibility in how sales are conducted.

Restrictions on Material Sourcing

The bill includes restrictions on where the materials for producing these magnets can come from. Specifically, if component materials are sourced from a non-allied foreign nation

, the credit will not be available for those magnets. There is a delayed restriction for some materials until 2027 to ease the transition for manufacturers using certain rare earth materials.

Coercivity Requirement

The act defines a rare earth magnet as one that maintains specific properties, including a coercivity level that ensures it operates effectively in various applications. There are provisions for exceptions to this coercivity requirement for manufacturers that meet certain eligibility criteria and are engaged in projects that align with national security interests.

Elective Payment Option

Manufacturers have the option to elect to treat the tax credits as payments against their tax liabilities. This means they can reduce their tax payments by the amount of the credit, potentially providing immediate financial relief rather than waiting until they file their tax returns.

Phased Phase-Out of Credits

Starting in 2034, the tax credit amount will begin to phase out for new production. This will reduce the incentives gradually over the following years, with no credits available for magnets produced after 2037.

Effective Date

The provisions within this bill are set to apply to taxable years starting after December 31, 2024, allowing a period for manufacturers to adapt to these new incentives and regulations.

Definitions

To clarify terms related to this bill, it provides specific definitions for key phrases, including what qualifies as a rare earth magnet, component rare earth materials, what it means to manufacture, and the criteria for being considered a domestic operation.

Relevant Companies

- MP Materials Corp (MP): A significant player in the rare earth materials space, this company could benefit from increased incentives for production as it is focused on producing rare earth materials and magnets domestically.

- REE Automotive Ltd (REE): As a company involved in the production of electric vehicles (EVs), which utilize rare earth magnets, it may see impacts regarding the supply chain and material costs.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

28 bill sponsors

-

TrackGuy Reschenthaler

Sponsor

-

TrackKen Calvert

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackKathy Castor

Co-Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackSharice Davids

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackBrad Finstad

Co-Sponsor

-

TrackCharles J. "Chuck" Fleischmann

Co-Sponsor

-

TrackJohn Garamendi

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackChrissy Houlahan

Co-Sponsor

-

TrackRichard Hudson

Co-Sponsor

-

TrackRaja Krishnamoorthi

Co-Sponsor

-

TrackSusie Lee

Co-Sponsor

-

TrackBetty McCollum

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackCory Mills

Co-Sponsor

-

TrackJohn R. Moolenaar

Co-Sponsor

-

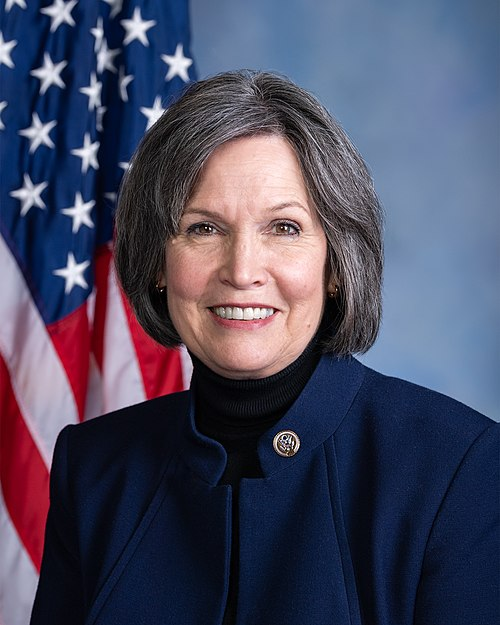

TrackKelly Morrison

Co-Sponsor

-

TrackJay Obernolte

Co-Sponsor

-

TrackJimmy Panetta

Co-Sponsor

-

TrackPete Stauber

Co-Sponsor

-

TrackEric Swalwell

Co-Sponsor

-

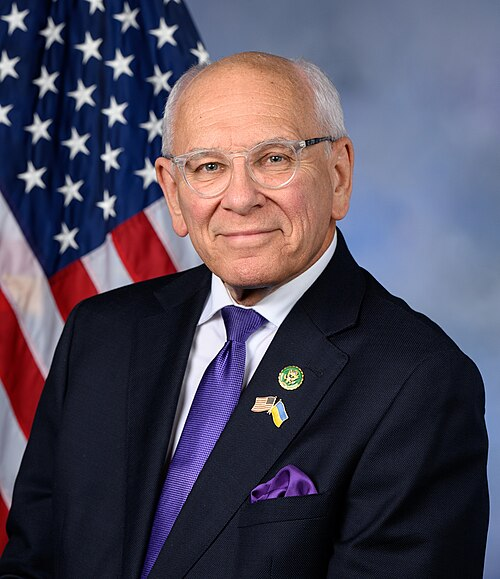

TrackPaul Tonko

Co-Sponsor

-

TrackDavid G. Valadao

Co-Sponsor

-

TrackMarc A. Veasey

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 21, 2025 | Introduced in House |

| Feb. 21, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.