H.R. 1490: TRIO Access Act

This bill, known as the TRIO Access Act, aims to modify existing provisions in the Internal Revenue Code and the Higher Education Act of 1965 to allow certain information to be used for specific educational programs. Here’s a breakdown of its key components:

Purpose of the Bill

The primary goal of the TRIO Access Act is to enhance the ability of institutions of higher education to utilize federal tax return information for the purpose of aiding students who are eligible for Federal TRIO programs. These programs are designed to support students from disadvantaged backgrounds in their pursuit of a college education.

Changes to the Internal Revenue Code

The bill proposes an amendment to Section 6103 of the Internal Revenue Code, specifically adding provisions that allow institutions to use certain tax return information for:

- The Ronald E. McNair Post-Baccalaureate Achievement Program.

- Student Support Services programs.

Amendments to the Higher Education Act of 1965

The TRIO Access Act also proposes specific amendments to various sections of the Higher Education Act:

- Authorization to disclose FAFSA information: The bill modifies existing rules to allow institutions to disclose information specifically for the programs mentioned above.

- Use of information provided to the institution: The amended section clarifies that information obtained from tax returns can be exclusively used for financial aid applications, awards, administration, and for authorized TRIO programs.

- Notification and Approval Requirements: Changes will be made to ensure that the process of requesting tax return information includes provisions for individuals who might be unable to determine their eligibility for the TRIO programs without this information.

Implications of the Bill

By allowing institutions greater access to tax information, the bill aims to facilitate more effective financial support for students who may be underrepresented in higher education. It is expected to streamline the application and administrative processes associated with both federal financial aid and TRIO programs.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

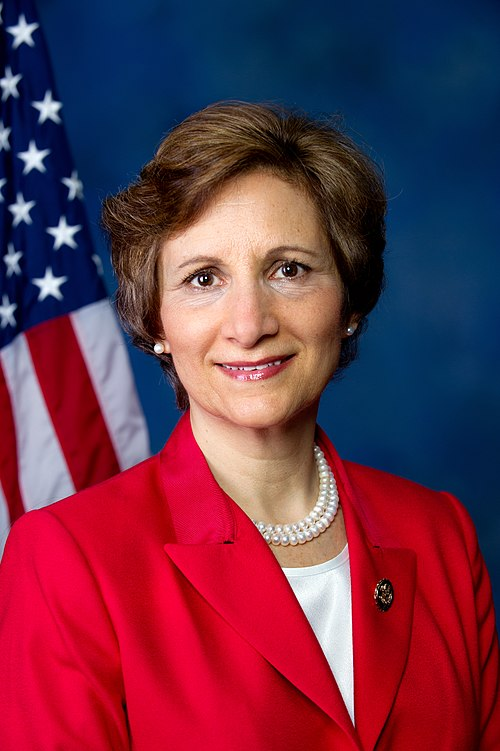

Sponsors

5 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 21, 2025 | Introduced in House |

| Feb. 21, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Education and Workforce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.