H.R. 1168: Protecting Federal Funds from Human Trafficking and Smuggling Act of 2025

This bill, titled the "Protecting Federal Funds from Human Trafficking and Smuggling Act of 2025," aims to ensure that federal funds are not awarded to non-profit organizations involved in violations related to human trafficking and alien smuggling. Here’s a breakdown of the key provisions:

Mandatory Disclosures

The bill mandates that any non-profit organization applying for federal funds must certify its compliance with federal laws addressing human trafficking, alien smuggling, and related offenses. This requirement takes effect:

- For future applicants: Organizations must provide the required certification before receiving federal funds.

- For current and prior recipients: Organizations already receiving federal funds must submit their certification within 60 days of the bill's enactment.

If an organization fails to submit the certification or is found to have violated the relevant laws, it must repay any federal funds received.

Tax Exemption Denials

The legislation also introduces a provision to amend the Internal Revenue Code regarding tax exemptions for non-profit organizations:

- If a non-profit does not meet the certification requirement or is found in violation of human trafficking laws, it will lose its tax-exempt status.

- Organizations may reapply for tax exemption after one year of non-compliance.

Reporting and Compliance Strategies

Within 120 days of the bill's enactment, the Secretary of Homeland Security is required to:

- Develop a strategy and best practices guide for non-profits regarding compliance with federal laws, including methods to detect and report human trafficking and alien smuggling.

- Publish information on the Department of Homeland Security’s website about any compliance violations by non-profit entities.

- Establish a strategy to enhance cooperation among non-profits, as well as state and federal law enforcement, in combating trafficking and smuggling issues.

Annual Reporting

The bill mandates the Comptroller General of the United States to report to Congress within 180 days of enactment and then annually on violations by non-profit entities regarding compliance certifications.

Scope of Applicability

The requirements of this bill apply to all non-profit entities receiving federal funding at the time of the bill's enactment, including those with existing agreements or contracts with the federal government.

Verification Requirement Adjustment

The legislation also proposes to amend existing provisions regarding verification for non-profit charitable organizations, specifically altering Section 432 of the Personal Responsibility and Work Opportunity Reconciliation Act of 1996.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

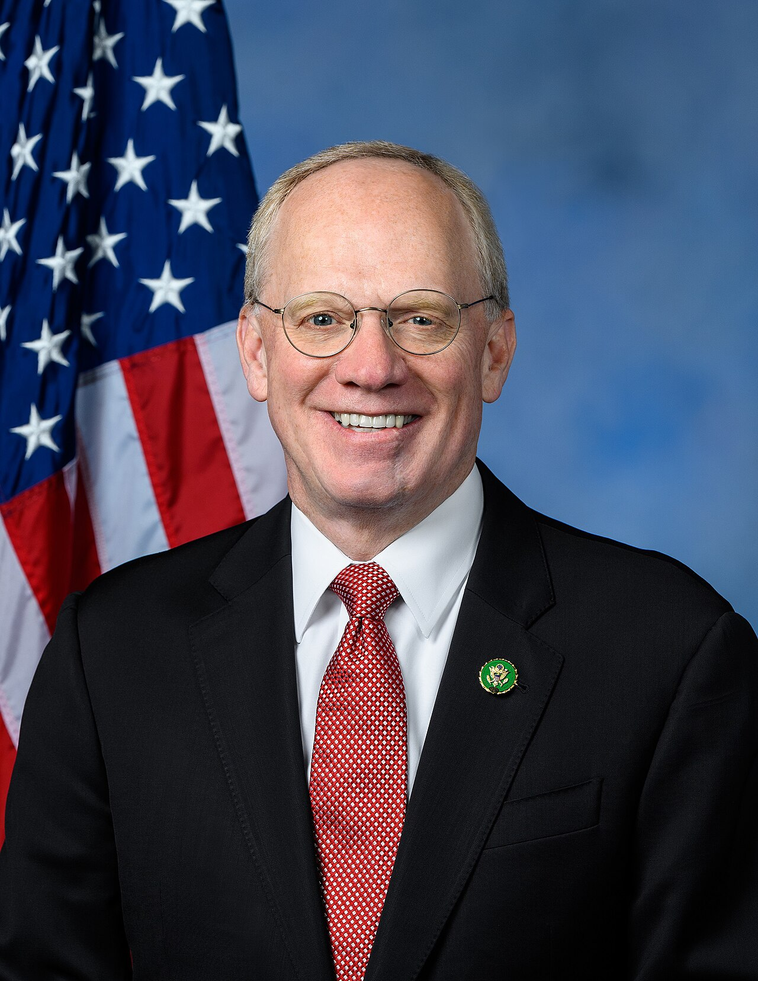

TrackLance Gooden

Sponsor

-

TrackAndy Biggs

Co-Sponsor

-

TrackJake Ellzey

Co-Sponsor

-

TrackBrandon Gill

Co-Sponsor

-

TrackPaul A. Gosar

Co-Sponsor

-

TrackMike Haridopolos

Co-Sponsor

-

TrackNancy Mace

Co-Sponsor

-

TrackAndrew Ogles

Co-Sponsor

-

TrackJohn W. Rose

Co-Sponsor

-

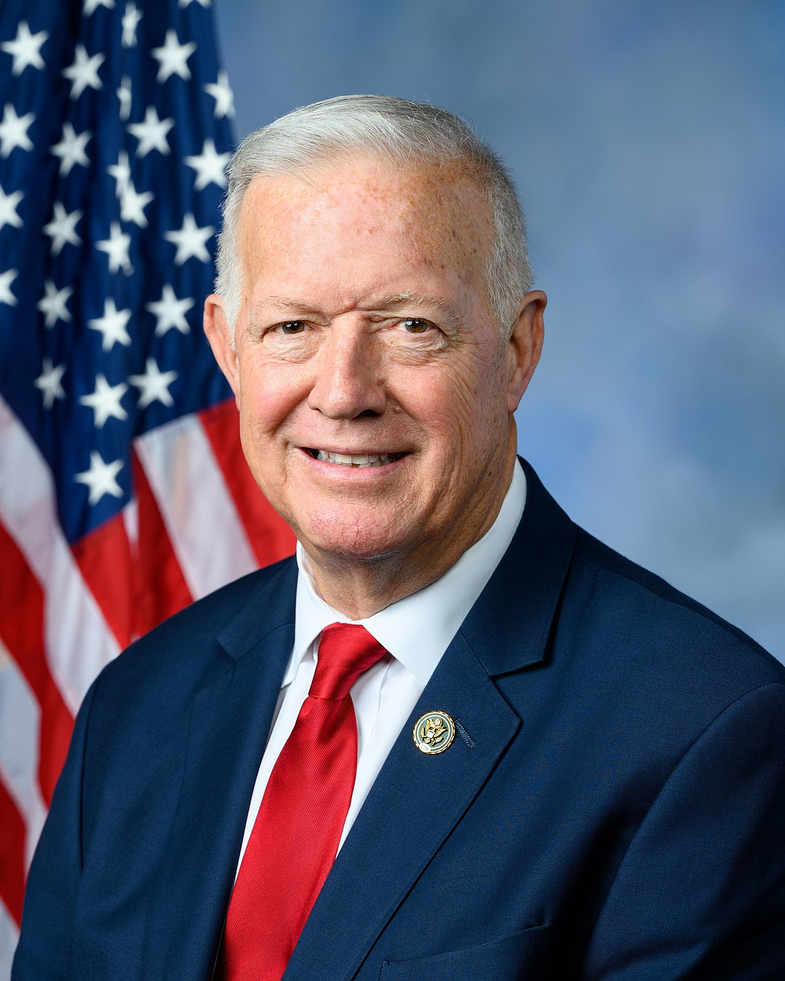

TrackThomas P. Tiffany

Co-Sponsor

-

TrackRandy K. Weber, Sr.

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 10, 2025 | Introduced in House |

| Feb. 10, 2025 | Referred to the Committee on the Judiciary, and in addition to the Committees on Oversight and Government Reform, and Ways and Means, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.