H.R. 5535: Insurance Data Protection Act

This bill, known as the Insurance Data Protection Act, proposes several changes regarding how financial regulators can collect and handle data from insurance companies. Below are the main points of the bill:

Prohibiting Direct Data Collection

The bill prohibits the Federal Insurance Office and other financial regulators from directly collecting data from insurance companies. Instead, these regulators must coordinate with relevant federal agencies and state insurance regulators to obtain data. This aims to ensure that regulators only collect necessary data that cannot be obtained from existing sources.

Amendments to Existing Laws

Several amendments to existing laws are included in the bill:

- Repeal of Subpoena Power: The bill removes a specific paragraph that grants subpoena powers to the Office of Financial Research concerning insurance companies.

- Confidentiality Provisions: It establishes that sharing nonpublic data with financial regulators does not waive any existing confidentiality privileges.

- Data Collection Coordination: Before collecting data, financial regulators must determine if the information is readily available from other agencies or sources. If available, they must obtain it from those sources instead of insurance companies.

Information-Sharing Agreements

The bill allows for data and information obtained by financial regulators to be shared with state insurance regulators—provided that appropriate information-sharing agreements are established. These agreements must comply with federal law while preserving any privilege associated with the data.

Definitions

The bill clarifies definitions relevant to financial regulators and insurance companies to ensure consistency across the legislation.

Confidentiality Maintenance

Confidentiality agreements and data protections established under federal or state law must remain in force even after data is shared with financial regulators. This is to protect the privacy and confidentiality of sensitive information.

Compliance with Federal Information Policy

In any case where financial regulators collect data from insurance companies, they must adhere to the existing federal information policy, commonly referred to as the Paperwork Reduction Act. This mandates a structured approach to collecting and managing information.

Summary of Intent

The overarching intent of the Insurance Data Protection Act is to reinforce the confidentiality of sensitive data held by insurance companies while also allowing for effective oversight by financial regulators, provided they follow specified procedures for data collection and sharing.

Relevant Companies

- PNC - PNC Financial Services Group may be indirectly impacted as a parent company that could be required to share data involving its insurance subsidiaries.

- AFL - Aflac, a well-known insurance provider, would be directly affected as the bill limits data collection from insurers.

- ALL - Allstate Corporation, another significant player in the insurance sector, would need to adjust its data sharing policies in light of this legislation.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

31 bill sponsors

-

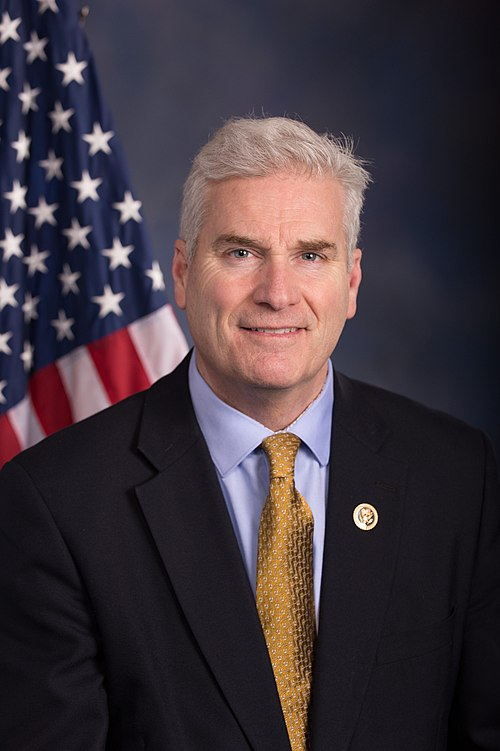

TrackScott Fitzgerald

Sponsor

-

TrackAndy Barr

Co-Sponsor

-

TrackJerry L. Carl

Co-Sponsor

-

TrackMonica De La Cruz

Co-Sponsor

-

TrackByron Donalds

Co-Sponsor

-

TrackTom Emmer

Co-Sponsor

-

TrackMike Flood

Co-Sponsor

-

TrackAndrew R. Garbarino

Co-Sponsor

-

TrackGlenn Grothman

Co-Sponsor

-

TrackHarriet M. Hageman

Co-Sponsor

-

TrackErin Houchin

Co-Sponsor

-

TrackBill Huizenga

Co-Sponsor

-

TrackDarrell Issa

Co-Sponsor

-

TrackDarin LaHood

Co-Sponsor

-

TrackNicholas A. Langworthy

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackBarry Loudermilk

Co-Sponsor

-

TrackBlaine Luetkemeyer

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackJohn R. Moolenaar

Co-Sponsor

-

TrackBarry Moore

Co-Sponsor

-

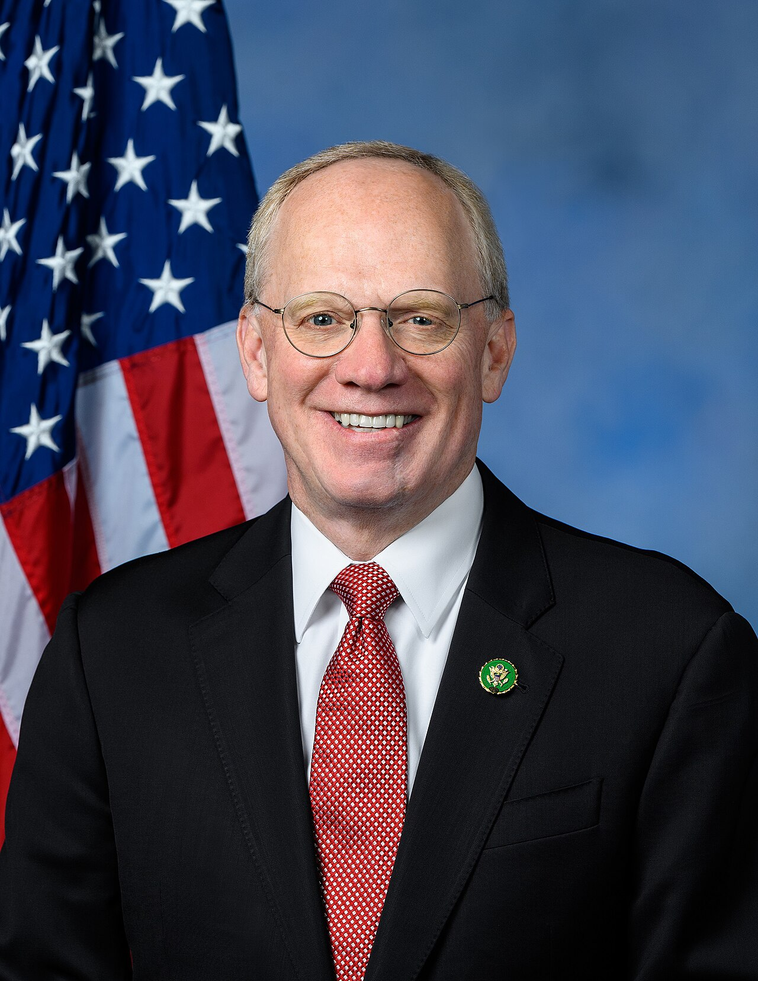

TrackRalph Norman

Co-Sponsor

-

TrackZachary Nunn

Co-Sponsor

-

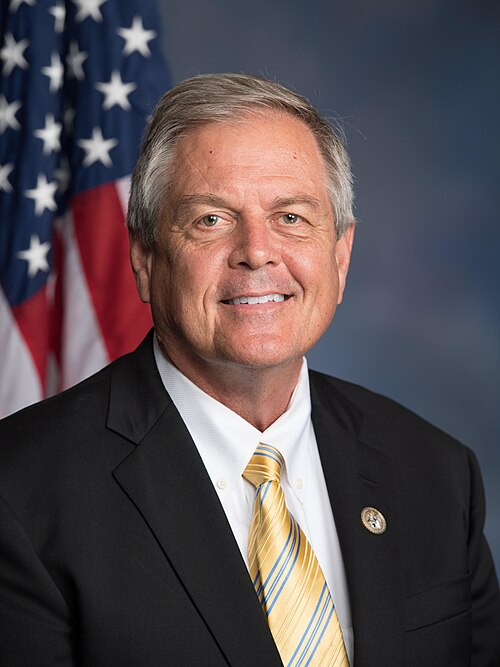

TrackMike Rogers

Co-Sponsor

-

TrackJohn W. Rose

Co-Sponsor

-

TrackPete Sessions

Co-Sponsor

-

TrackPete Stauber

Co-Sponsor

-

TrackBryan Steil

Co-Sponsor

-

TrackDale W. Strong

Co-Sponsor

-

TrackWilliam R. Timmons IV

Co-Sponsor

-

TrackRoger Williams

Co-Sponsor

Actions

9 actions

| Date | Action |

|---|---|

| Dec. 19, 2024 | Committee on Agriculture discharged. |

| Dec. 19, 2024 | Placed on the Union Calendar, Calendar No. 787. |

| Nov. 21, 2024 | House Committee on Agriculture Granted an extension for further consideration ending not later than Dec. 19, 2024. |

| Nov. 21, 2024 | Reported (Amended) by the Committee on Financial Services. H. Rept. 118-759, Part I. |

| Apr. 17, 2024 | Committee Consideration and Mark-up Session Held |

| Apr. 17, 2024 | Ordered to be Reported in the Nature of a Substitute (Amended) by the Yeas and Nays: 28 - 22. |

| Sep. 26, 2023 | Referred to the Subcommittee on Commodity Markets, Digital Assets, and Rural Development. |

| Sep. 18, 2023 | Introduced in House |

| Sep. 18, 2023 | Referred to the Committee on Financial Services, and in addition to the Committee on Agriculture, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.