Quiver News

The latest insights and financial news from Quiver Quantitative

Representative Josh Gottheimer made $288.2K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative Josh Gottheimer Net Worth

Quiver Quantitative estimates that Representative Josh Gottheimer is worth $42.5M, as of November 2nd, 2025. This is the 35th highest net worth in Congress, per our live estimates.

Gottheimer has approximately $25.0M invested in publicly traded assets which Quiver is able to track live.

You can track Representative Josh Gottheimer's net worth on Quiver Quantitative's politician page for Gottheimer.

Representative Josh Gottheimer Stock Trading

We have data on up to $564.0M of trades from Representative Josh Gottheimer, which we parsed from STOCK Act filings. Some of the largest trades include:

- A February 12th, 2024 sale of up to $5M of $MSFT. The stock has risen 24.7% since then.

- A May 18th, 2020 sale of up to $100K of $AMZN. The stock has risen 101.31% since then.

- A March 17th, 2020 purchase of up to $50K of $BX. The stock has risen 253.86% since then.

- A December 18th, 2018 sale of up to $50K of $XOM. The stock has risen 58.83% since then.

- A December 18th, 2017 sale of up to $50K of $SLB. The stock has fallen 43.3% since then.

You can track Representative Josh Gottheimer's stock trading on Quiver Quantitative's politician page for Gottheimer.

Representative Josh Gottheimer Bill Proposals

Here are some bills which have recently been proposed by Representative Josh Gottheimer:

- H.R.5715: October 7 Gold Medal Act

- H.R.5714: October 7 Remembrance Education Act

- H.R.5681: STOP HATE Act of 2025

- H.R.5623: SEIZE Act of 2025

- H.R.5579: ETA Act of 2025

- H.R.5265: SAFE Ride Act of 2025

You can track bills proposed by Representative Josh Gottheimer on Quiver Quantitative's politician page for Gottheimer.

Representative Josh Gottheimer Fundraising

Representative Josh Gottheimer recently disclosed $412.7K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 211th most from all Q3 reports we have seen this year. 71.4% came from individual donors.

Gottheimer disclosed $45.2K of spending. This was the 811th most from all Q3 reports we have seen from politicians so far this year.

Gottheimer disclosed $9.4M of cash on hand at the end of the filing period. This was the 17th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Representative Josh Gottheimer's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Representative John W. Rose lost $630.9K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative John W. Rose Net Worth

Quiver Quantitative estimates that Representative John W. Rose is worth $57.4M, as of November 2nd, 2025. This is the 26th highest net worth in Congress, per our live estimates.

Rose has approximately $1.0M invested in publicly traded assets which Quiver is able to track live.

You can track Representative John W. Rose's net worth on Quiver Quantitative's politician page for Rose.

Representative John W. Rose Stock Trading

We have data on up to $23.7M of trades from Representative John W. Rose, which we parsed from STOCK Act filings. Some of the largest trades include:

- A June 3rd, 2025 sale of up to $5M of $GOOGL. The stock has risen 69.21% since then.

- A November 12th, 2019 sale of up to $1M of $MSFT. The stock has risen 252.08% since then.

- A November 12th, 2019 sale of up to $500K of $CAT. The stock has risen 294.46% since then.

- A November 12th, 2019 sale of up to $500K of $BAC. The stock has risen 61.53% since then.

- A June 3rd, 2025 sale of up to $500K of $GOOG. The stock has risen 68.04% since then.

You can track Representative John W. Rose's stock trading on Quiver Quantitative's politician page for Rose.

Representative John W. Rose Bill Proposals

Here are some bills which have recently been proposed by Representative John W. Rose:

- H.R.2885: Bank Loan Privacy Act

- H.R.2808: Homebuyers Privacy Protection Act

- H.R.2462: Black Vulture Relief Act

- H.R.2274: Court Shopping Deterrence Act

- H.R.1631: Safe Access to Cash Act of 2025

- H.R.1138: Payment Choice Act of 2025

You can track bills proposed by Representative John W. Rose on Quiver Quantitative's politician page for Rose.

Representative John W. Rose Fundraising

Representative John W. Rose recently disclosed $3.1K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 1257th most from all Q3 reports we have seen this year. 100.0% came from individual donors.

Rose disclosed $59.9K of spending. This was the 743rd most from all Q3 reports we have seen from politicians so far this year.

Rose disclosed $167.3K of cash on hand at the end of the filing period. This was the 814th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Representative John W. Rose's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Representative Darrell Issa made $328.7K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative Darrell Issa Net Worth

Quiver Quantitative estimates that Representative Darrell Issa is worth $284.8M, as of November 2nd, 2025. This is the 4th highest net worth in Congress, per our live estimates.

Issa has approximately $23.4M invested in publicly traded assets which Quiver is able to track live.

You can track Representative Darrell Issa's net worth on Quiver Quantitative's politician page for Issa.

Representative Darrell Issa Stock Trading

We have data on up to $405.0M of trades from Representative Darrell Issa, which we parsed from STOCK Act filings.

You can track Representative Darrell Issa's stock trading on Quiver Quantitative's politician page for Issa.

Representative Darrell Issa Bill Proposals

Here are some bills which have recently been proposed by Representative Darrell Issa:

- H.R.5682: To take certain land in the State of California into trust for the benefit of the Pechanga Band of Indians, and for other purposes.

- H.R.5632: PEACE Act

- H.R.5042: To define "showerhead" for the purpose of determining the acceptable water pressure for a showerhead, and for other purposes.

- H.R.4982: To designate the facility of the United States Postal Service located at 1444 Main Street in Ramona, California, as the "Archie Moore Post Office Building".

- H.R.4887: SIPS Act

- H.R.4676: Modern Firearm Safety Act

You can track bills proposed by Representative Darrell Issa on Quiver Quantitative's politician page for Issa.

Representative Darrell Issa Fundraising

Representative Darrell Issa recently disclosed $264.6K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 360th most from all Q3 reports we have seen this year. 52.0% came from individual donors.

Issa disclosed $136.3K of spending. This was the 448th most from all Q3 reports we have seen from politicians so far this year.

Issa disclosed $2.5M of cash on hand at the end of the filing period. This was the 136th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Representative Darrell Issa's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Representative Mike Kelly made $162.8K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative Mike Kelly Net Worth

Quiver Quantitative estimates that Representative Mike Kelly is worth $16.1M, as of November 2nd, 2025. This is the 82nd highest net worth in Congress, per our live estimates.

Kelly has approximately $5.8M invested in publicly traded assets which Quiver is able to track live.

You can track Representative Mike Kelly's net worth on Quiver Quantitative's politician page for Kelly.

Representative Mike Kelly Stock Trading

We have data on up to $5.6M of trades from Representative Mike Kelly, which we parsed from STOCK Act filings. Some of the largest trades include:

- A March 28th, 2024 purchase of up to $100K of $CLF. The stock has fallen 45.34% since then.

- A June 20th, 2025 sale of up to $50K of $X.

- A November 8th, 2024 sale of up to $50K of $UNP. The stock has fallen 8.75% since then.

- A April 12th, 2024 sale of up to $15K of $VZ. The stock has risen 0.05% since then.

- A April 12th, 2024 sale of up to $15K of $CVX. The stock has fallen 0.78% since then.

You can track Representative Mike Kelly's stock trading on Quiver Quantitative's politician page for Kelly.

Representative Mike Kelly Bill Proposals

Here are some bills which have recently been proposed by Representative Mike Kelly:

- H.R.5275: Diagnostic Accuracy in Sepsis Act of 2025

- H.R.4566: Washington’s Trail—1753 National Historic Trail Feasibility Study Act of 2025

- H.R.4547: To advance Thomas B. Hagen on the retired list of the Navy.

- H.R.4231: Treat and Reduce Obesity Act of 2025

- H.R.4184: To amend the Internal Revenue Code of 1986 to exclude from gross income certain compensation to clinical trial participants, and for other purposes.

- H.R.3687: To amend the Internal Revenue Code of 1986 to renew and enhance opportunity zones, and for other purposes.

You can track bills proposed by Representative Mike Kelly on Quiver Quantitative's politician page for Kelly.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Representative Max L. Miller made $102.0K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative Max L. Miller Net Worth

Quiver Quantitative estimates that Representative Max L. Miller is worth $11.6M, as of November 2nd, 2025. This is the 100th highest net worth in Congress, per our live estimates.

Miller has approximately $4.5M invested in publicly traded assets which Quiver is able to track live.

You can track Representative Max L. Miller's net worth on Quiver Quantitative's politician page for Miller.

Representative Max L. Miller Stock Trading

We have data on up to $985.0K of trades from Representative Max L. Miller, which we parsed from STOCK Act filings. Some of the largest trades include:

- A October 6th, 2023 sale of up to $50K of $VOO. The stock has risen 58.92% since then.

- A October 6th, 2023 sale of up to $15K of $JEPI. The stock has risen 7.3% since then.

- A October 6th, 2023 sale of up to $15K of $VO. The stock has risen 40.93% since then.

You can track Representative Max L. Miller's stock trading on Quiver Quantitative's politician page for Miller.

Representative Max L. Miller Bill Proposals

Here are some bills which have recently been proposed by Representative Max L. Miller:

- H.R.5779: American Workforce Act

- H.R.4625: NEPTUNE Act

- H.R.4193: Time is Money Act

- H.R.4141: Advanced Weather Model Computing Development Act

- H.R.3358: Harvest to Hue Act

- H.R.2871: Safeguarding U.S. Supply Chains Act

You can track bills proposed by Representative Max L. Miller on Quiver Quantitative's politician page for Miller.

Representative Max L. Miller Fundraising

Representative Max L. Miller recently disclosed $245.2K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 390th most from all Q3 reports we have seen this year. 75.1% came from individual donors.

Miller disclosed $157.4K of spending. This was the 385th most from all Q3 reports we have seen from politicians so far this year.

Miller disclosed $843.6K of cash on hand at the end of the filing period. This was the 390th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Representative Max L. Miller's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Representative David Kustoff made $104.7K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative David Kustoff Net Worth

Quiver Quantitative estimates that Representative David Kustoff is worth $8.7M, as of November 2nd, 2025. This is the 120th highest net worth in Congress, per our live estimates.

Kustoff has approximately $2.8M invested in publicly traded assets which Quiver is able to track live.

You can track Representative David Kustoff's net worth on Quiver Quantitative's politician page for Kustoff.

Representative David Kustoff Bill Proposals

Here are some bills which have recently been proposed by Representative David Kustoff:

- H.R.5345: Improving Social Security’s Service to Victims of Identity Theft Act

- H.R.5242: To repeal the Second Chance Amendment Act of 2022 and the Incarceration Reduction Amendment Act of 2016.

- H.R.4334: Restoring the Armed Career Criminal Act

- H.R.3976: NCAA Accountability Act of 2025

- H.R.3155: Child Care for American Families Act

- H.R.3108: RPM Access Act

You can track bills proposed by Representative David Kustoff on Quiver Quantitative's politician page for Kustoff.

Representative David Kustoff Fundraising

Representative David Kustoff recently disclosed $0 of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 1495th most from all Q3 reports we have seen this year. nan% came from individual donors.

Kustoff disclosed $15.0K of spending. This was the 1063rd most from all Q3 reports we have seen from politicians so far this year.

Kustoff disclosed $8.6K of cash on hand at the end of the filing period. This was the 1400th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Representative David Kustoff's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Representative Ed Case made $221.7K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative Ed Case Net Worth

Quiver Quantitative estimates that Representative Ed Case is worth $5.9M, as of November 2nd, 2025. This is the 156th highest net worth in Congress, per our live estimates.

Case has approximately $4.1M invested in publicly traded assets which Quiver is able to track live.

You can track Representative Ed Case's net worth on Quiver Quantitative's politician page for Case.

Representative Ed Case Stock Trading

We have data on up to $510.0K of trades from Representative Ed Case, which we parsed from STOCK Act filings. Some of the largest trades include:

- A May 3rd, 2021 sale of up to $100K of $MO. The stock has risen 16.56% since then.

- A May 3rd, 2021 purchase of up to $100K of $MSFT. The stock has risen 105.59% since then.

- A May 3rd, 2021 sale of up to $15K of $GE. The stock has risen 360.87% since then.

- A May 3rd, 2021 sale of up to $15K of $KMI. The stock has risen 51.74% since then.

- A July 2nd, 2021 purchase of up to $15K of $MRIN. The stock has fallen 99.26% since then.

You can track Representative Ed Case's stock trading on Quiver Quantitative's politician page for Case.

Representative Ed Case Bill Proposals

Here are some bills which have recently been proposed by Representative Ed Case:

- H.R.4839: Merchant Marine Allies Partnership Act

- H.R.4276: To amend the Native American Tourism and Improving Visitor Experience Act to authorize grants to Indian tribes, tribal organizations, and Native Hawaiian organizations, and for other purposes.

- H.R.4219: National Wildlife Refuge System Invasive Species Strike Team Act of 2025

- H.R.4025: Energy Transitions Initiative Authorization Act of 2025

- H.R.3332: Pacific Partnership Act

- H.R.2993: ESOP Funding for SBA Position Act of 2025

You can track bills proposed by Representative Ed Case on Quiver Quantitative's politician page for Case.

Representative Ed Case Fundraising

Representative Ed Case recently disclosed $108.9K of fundraising in a Q3 FEC disclosure filed on October 13th, 2025. This was the 681st most from all Q3 reports we have seen this year. 34.8% came from individual donors.

Case disclosed $31.9K of spending. This was the 892nd most from all Q3 reports we have seen from politicians so far this year.

Case disclosed $581.1K of cash on hand at the end of the filing period. This was the 484th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Representative Ed Case's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Representative Pete Sessions made $127.8K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative Pete Sessions Net Worth

Quiver Quantitative estimates that Representative Pete Sessions is worth $9.9M, as of November 2nd, 2025. This is the 108th highest net worth in Congress, per our live estimates.

Sessions has approximately $3.4M invested in publicly traded assets which Quiver is able to track live.

You can track Representative Pete Sessions's net worth on Quiver Quantitative's politician page for Sessions.

Representative Pete Sessions Stock Trading

We have data on up to $17.4M of trades from Representative Pete Sessions, which we parsed from STOCK Act filings. Some of the largest trades include:

- A October 31st, 2023 sale of up to $500K of $BUI. The stock has risen 36.89% since then.

- A September 10th, 2021 sale of up to $250K of $AAPL. The stock has risen 81.49% since then.

- A October 31st, 2023 sale of up to $250K of $PG. The stock has risen 0.23% since then.

- A October 31st, 2023 sale of up to $250K of $LMT. The stock has risen 8.19% since then.

- A September 10th, 2021 sale of up to $250K of $JPM. The stock has risen 97.71% since then.

You can track Representative Pete Sessions's stock trading on Quiver Quantitative's politician page for Sessions.

Representative Pete Sessions Bill Proposals

Here are some bills which have recently been proposed by Representative Pete Sessions:

- H.R.5125: District of Columbia Judicial Nominations Reform Act of 2025

- H.R.4863: Fairness for Khobar Act of 2025

- H.R.3420: Words Matter Act of 2025

- H.R.3417: Websites and Software Applications Accessibility Act of 2025

- H.R.3416: Accessibility Constituent Communication Act of 2025

- H.R.3092: Electrodiagnostic Medicine Patient Protection and Fraud Elimination Act of 2025

You can track bills proposed by Representative Pete Sessions on Quiver Quantitative's politician page for Sessions.

Representative Pete Sessions Fundraising

Representative Pete Sessions recently disclosed $196.4K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 474th most from all Q3 reports we have seen this year. 24.7% came from individual donors.

Sessions disclosed $71.6K of spending. This was the 694th most from all Q3 reports we have seen from politicians so far this year.

Sessions disclosed $676.4K of cash on hand at the end of the filing period. This was the 442nd most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Representative Pete Sessions's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Senator Michael F. Bennet made $110.4K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Senator Michael F. Bennet Net Worth

Quiver Quantitative estimates that Senator Michael F. Bennet is worth $18.0M, as of November 2nd, 2025. This is the 72nd highest net worth in Congress, per our live estimates.

Bennet has approximately $3.6M invested in publicly traded assets which Quiver is able to track live.

You can track Senator Michael F. Bennet's net worth on Quiver Quantitative's politician page for Bennet.

Senator Michael F. Bennet Stock Trading

We have data on up to $4.2M of trades from Senator Michael F. Bennet, which we parsed from STOCK Act filings. Some of the largest trades include:

- A March 28th, 2017 sale of up to $1M of $RGC. The stock has risen 2765.26% since then.

You can track Senator Michael F. Bennet's stock trading on Quiver Quantitative's politician page for Bennet.

Senator Michael F. Bennet Bill Proposals

Here are some bills which have recently been proposed by Senator Michael F. Bennet:

- S.2791: SEED Act

- S.2701: Headwaters Protection Act of 2025

- S.2669: A bill to require the Secretary of Defense to develop and implement a strategy to strengthen multilateral deterrence in the Indo-Pacific region.

- S.2518: Protecting Air Ambulance Services for Americans Act of 2025

- S.2496: Keep Kids Covered Act

- S.2380: Quad Economic Security Act

You can track bills proposed by Senator Michael F. Bennet on Quiver Quantitative's politician page for Bennet.

Senator Michael F. Bennet Fundraising

Senator Michael F. Bennet recently disclosed $0 of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 1495th most from all Q3 reports we have seen this year. nan% came from individual donors.

Bennet disclosed $100.02 of spending. This was the 1717th most from all Q3 reports we have seen from politicians so far this year.

Bennet disclosed $2.4K of cash on hand at the end of the filing period. This was the 1679th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Senator Michael F. Bennet's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Representative Scott H. Peters made $239.1K in the stock market last month, per Quiver Quantitative's live net worth estimates.

Representative Scott H. Peters Net Worth

Quiver Quantitative estimates that Representative Scott H. Peters is worth $59.4M, as of November 2nd, 2025. This is the 25th highest net worth in Congress, per our live estimates.

Peters has approximately $24.4M invested in publicly traded assets which Quiver is able to track live.

You can track Representative Scott H. Peters's net worth on Quiver Quantitative's politician page for Peters.

Representative Scott H. Peters Stock Trading

We have data on up to $240.7M of trades from Representative Scott H. Peters, which we parsed from STOCK Act filings. Some of the largest trades include:

- A August 1st, 2018 sale of up to $100K of $RAND. The stock has fallen 37.85% since then.

You can track Representative Scott H. Peters's stock trading on Quiver Quantitative's politician page for Peters.

Representative Scott H. Peters Bill Proposals

Here are some bills which have recently been proposed by Representative Scott H. Peters:

- H.R.5887: To establish a universal personal savings program, and for other purposes.

- H.R.5755: No Budget, No Pay Act

- H.R.5601: Faith in Housing Act of 2025

- H.R.5600: SPEED and Reliability Act of 2025

- H.R.5443: Fair Housing Improvement Act of 2025

- H.R.5119: National Security Climate Intelligence Act of 2025

You can track bills proposed by Representative Scott H. Peters on Quiver Quantitative's politician page for Peters.

Representative Scott H. Peters Fundraising

Representative Scott H. Peters recently disclosed $197.8K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 469th most from all Q3 reports we have seen this year. 29.5% came from individual donors.

Peters disclosed $113.4K of spending. This was the 533rd most from all Q3 reports we have seen from politicians so far this year.

Peters disclosed $2.3M of cash on hand at the end of the filing period. This was the 143rd most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Representative Scott H. Peters's fundraising on Quiver Quantitative.

Note that our net worth numbers are estimates, based on financial disclosures, and the data may be inaccurate or incomplete. See Quiver Quantitative's disclaimers for more information.

Sen. Tim Scott visited Lockheed Martin in Greenville, emphasizing employee contributions to national security during a recent tour.

Quiver AI Summary

Senator Scott visits Lockheed Martin: U.S. Senator Tim Scott toured Lockheed Martin's Greenville facility, emphasizing its significant contribution to national security through its F-16 production. During his visit, he engaged with over 1,600 employees and expressed pride in their role in defending America. "Every single employee I met here – they are proud of the work they do," he stated.

Location and context: The Greenville site, situated in an Opportunity Zone, serves as a cornerstone for military aircraft production, including the F-35. Scott highlighted the importance of the partnership between South Carolina and Lockheed Martin, calling it a "marvel for our state and country."

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Tim Scott Net Worth

Quiver Quantitative estimates that Tim Scott is worth $5.8M, as of November 2nd, 2025. This is the 159th highest net worth in Congress, per our live estimates.

Scott has approximately $1.7M invested in publicly traded assets which Quiver is able to track live.

You can track Tim Scott's net worth on Quiver Quantitative's politician page for Scott.

Tim Scott Bill Proposals

Here are some bills which have recently been proposed by Tim Scott:

- S.3073: Pay Our Capitol Police Act

- S.2984: Employee Rights Act

- S.2814: Transit Crime Reporting Act of 2025

- S.2709: Telehealth Modernization Act

- S.2651: ROAD to Housing Act of 2025

- S.2486: Protecting Access to Credit for Small Businesses Act

You can track bills proposed by Tim Scott on Quiver Quantitative's politician page for Scott.

Tim Scott Fundraising

Tim Scott recently disclosed $787.2K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 71st most from all Q3 reports we have seen this year. 95.8% came from individual donors.

Scott disclosed $620.1K of spending. This was the 69th most from all Q3 reports we have seen from politicians so far this year.

Scott disclosed $5.3M of cash on hand at the end of the filing period. This was the 43rd most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Tim Scott's fundraising on Quiver Quantitative.

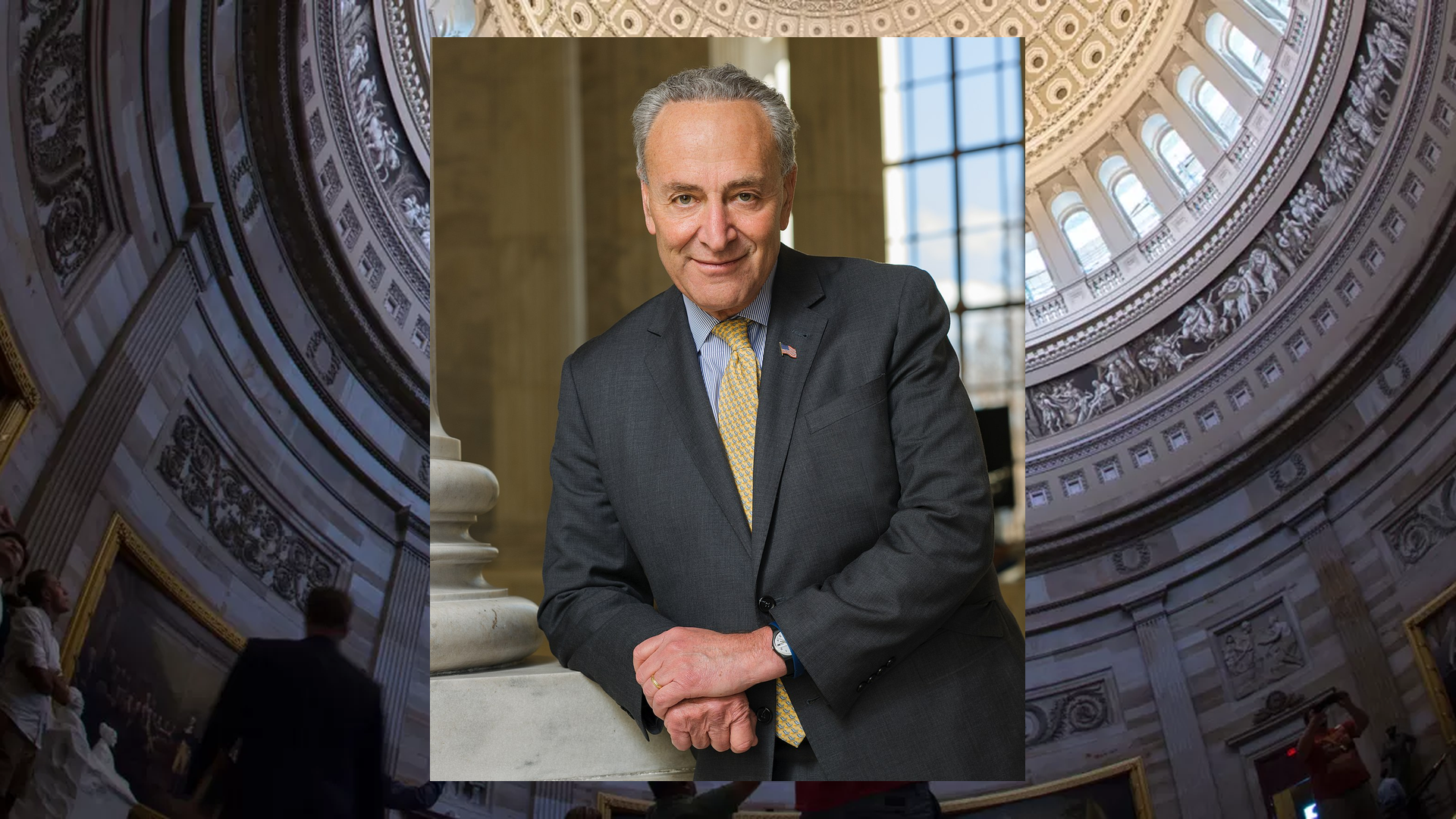

Schumer criticizes Republicans for not extending ACA tax credits, causing health insurance premiums to rise during open enrollment.

Quiver AI Summary

Senator Schumer addresses health insurance concerns: With the start of open enrollment for health insurance, Senator Chuck Schumer highlighted the potential for steep premium increases for New Yorkers. He attributed this to the expiration of Affordable Care Act (ACA) tax credits, calling for Republicans to negotiate a resolution to the ongoing healthcare crisis.

Impact on families: Schumer warned that many New Yorkers may face financial burden as health insurance costs could skyrocket without action. He urged collaboration between parties to extend tax credits, which could prevent millions from losing their health coverage or facing enormous monthly expenses.

Call to action: The senator emphasized that the Republicans must return to the negotiation table, stating that continued inaction would exacerbate the already critical situation for families and small business owners in New York.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Charles E. Schumer Net Worth

Quiver Quantitative estimates that Charles E. Schumer is worth $2.0M, as of November 2nd, 2025. This is the 256th highest net worth in Congress, per our live estimates.

Schumer has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Charles E. Schumer's net worth on Quiver Quantitative's politician page for Schumer.

Charles E. Schumer Bill Proposals

Here are some bills which have recently been proposed by Charles E. Schumer:

- S.2925: MIND Act of 2025

- S.2681: Lowering Electric Bills Act

- S.2556: Protecting Health Care and Lowering Costs Act

- S.2009: Charles B. Rangel Congressional Gold Medal Act

- S.1929: SEPSIS Act

- S.1804: Presidential Airlift Security Act of 2025

You can track bills proposed by Charles E. Schumer on Quiver Quantitative's politician page for Schumer.

Charles E. Schumer Fundraising

Charles E. Schumer recently disclosed $108.2K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 686th most from all Q3 reports we have seen this year. 88.9% came from individual donors.

Schumer disclosed $321.8K of spending. This was the 170th most from all Q3 reports we have seen from politicians so far this year.

Schumer disclosed $8.6M of cash on hand at the end of the filing period. This was the 21st most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Charles E. Schumer's fundraising on Quiver Quantitative.

Kalshi has reported 26,997 in volume over the last 24 hours on their market for “Will the Federal Reserve Cut rates by 25bps at their December 2025 meeting?”, making it one of the hottest markets on the platform today.

The market currently is implying a 66% chance for "Cut 25bps", which is neutral from yesterday, when the market implied a 66% probability.

If the Federal Reserve does a Cut of 25bps on December 10, 2025, then the market resolves to Yes.

In total, this market has seen a volume of 447,810 transactions since it was first opened on August 05, 2025. There are 345,891 positions of open interest in this market, and the overall liquidity is sitting at 17,227,841 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 1506291)

- Donald Trump out this year? (24h volume: 862770)

- Will a bill that removes/changes the gambling tax provision that OBBB becomes law before Jan 1, 2026? (24h volume: 499752)

- Will Jack Ciattarelli win the 2025 New Jersey gubernatorial election? (24h volume: 442678)

- Will Mikie Sherrill finish within 100 to -0.01 percentage points in New Jersey? (24h volume: 258073)

- Will Curtis Sliwa drop out of the NYC Mayoral race? (24h volume: 142901)

- Will J.B. Pritzker be the Democratic Presidential nominee in 2028? (24h volume: 130888)

- Margin of victory for Zohran Mamdani in the Mayoral Election? (24h volume: 93280)

- Will Winsome Earle-Sears win the 2025 Virginia gubernatorial election? (24h volume: 91280)

- Will Abigail Spanberger win by 4 to 5.99 percentage points in Virginia? (24h volume: 75153)

Kalshi has reported 1,506,291 in volume over the last 24 hours on their market for “Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025?”, making it one of the hottest markets on the platform today.

The market currently is implying a 8% chance for "Andrew Cuomo", which is neutral from yesterday, when the market implied a 8% probability.

If Andrew Cuomo (as an independent only) wins the NYC Mayoral election on Nov 4, 2025, then the market resolves to Yes.

In total, this market has seen a volume of 22,002,690 transactions since it was first opened on June 25, 2025. There are 12,626,650 positions of open interest in this market, and the overall liquidity is sitting at 497,394,211 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 1506291)

- Donald Trump out this year? (24h volume: 862770)

- Will a bill that removes/changes the gambling tax provision that OBBB becomes law before Jan 1, 2026? (24h volume: 499752)

- Will Jack Ciattarelli win the 2025 New Jersey gubernatorial election? (24h volume: 442678)

- Will Mikie Sherrill finish within 100 to -0.01 percentage points in New Jersey? (24h volume: 258073)

- Will Curtis Sliwa drop out of the NYC Mayoral race? (24h volume: 142901)

- Will J.B. Pritzker be the Democratic Presidential nominee in 2028? (24h volume: 130888)

- Margin of victory for Zohran Mamdani in the Mayoral Election? (24h volume: 93280)

- Will Winsome Earle-Sears win the 2025 Virginia gubernatorial election? (24h volume: 91280)

- Will Abigail Spanberger win by 4 to 5.99 percentage points in Virginia? (24h volume: 75153)

Kalshi has reported 16,359 in volume over the last 24 hours on their market for “Will Jim McGreevey win the election for the Mayor of Jersey City in 2025?”, making it one of the hottest markets on the platform today.

The market currently is implying a 77% chance for "Jim McGreevey", which is neutral from yesterday, when the market implied a 77% probability.

If Jim McGreevey is sworn in pursuant to the election for Mayor in Jersey City in 2025, then the market resolves to Yes.

In total, this market has seen a volume of 166,325 transactions since it was first opened on March 27, 2025. There are 127,707 positions of open interest in this market, and the overall liquidity is sitting at 2,492,892 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 1506291)

- Donald Trump out this year? (24h volume: 862770)

- Will a bill that removes/changes the gambling tax provision that OBBB becomes law before Jan 1, 2026? (24h volume: 499752)

- Will Jack Ciattarelli win the 2025 New Jersey gubernatorial election? (24h volume: 442678)

- Will Mikie Sherrill finish within 100 to -0.01 percentage points in New Jersey? (24h volume: 258073)

- Will Curtis Sliwa drop out of the NYC Mayoral race? (24h volume: 142901)

- Will J.B. Pritzker be the Democratic Presidential nominee in 2028? (24h volume: 130888)

- Margin of victory for Zohran Mamdani in the Mayoral Election? (24h volume: 93280)

- Will Winsome Earle-Sears win the 2025 Virginia gubernatorial election? (24h volume: 91280)

- Will Abigail Spanberger win by 4 to 5.99 percentage points in Virginia? (24h volume: 75153)

Kalshi has reported 11,236 in volume over the last 24 hours on their market for “Will the Federal Reserve hike rates by December 31, 2025?”, making it one of the hottest markets on the platform today.

The market currently is implying a 3% chance for "Before 2026", which is neutral from yesterday, when the market implied a 3% probability.

If the Federal Reserve hikes again by Dec 31, 2025, then the market resolves to Yes.

In total, this market has seen a volume of 375,609 transactions since it was first opened on December 14, 2023. There are 104,802 positions of open interest in this market, and the overall liquidity is sitting at 19,372,931 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 1506291)

- Donald Trump out this year? (24h volume: 862770)

- Will a bill that removes/changes the gambling tax provision that OBBB becomes law before Jan 1, 2026? (24h volume: 499752)

- Will Jack Ciattarelli win the 2025 New Jersey gubernatorial election? (24h volume: 442678)

- Will Mikie Sherrill finish within 100 to -0.01 percentage points in New Jersey? (24h volume: 258073)

- Will Curtis Sliwa drop out of the NYC Mayoral race? (24h volume: 142901)

- Will J.B. Pritzker be the Democratic Presidential nominee in 2028? (24h volume: 130888)

- Margin of victory for Zohran Mamdani in the Mayoral Election? (24h volume: 93280)

- Will Winsome Earle-Sears win the 2025 Virginia gubernatorial election? (24h volume: 91280)

- Will Abigail Spanberger win by 4 to 5.99 percentage points in Virginia? (24h volume: 75153)

Kalshi has reported 25,015 in volume over the last 24 hours on their market for “Will the Fed cut rates 5 times?”, making it one of the hottest markets on the platform today.

The market currently is implying a 1% chance for "Exactly 5 cuts", which is neutral from yesterday, when the market implied a 1% probability.

If the Fed cuts 5 times before 2026, the market resolves to Yes.

In total, this market has seen a volume of 1,293,820 transactions since it was first opened on December 20, 2024. There are 578,055 positions of open interest in this market, and the overall liquidity is sitting at 49,269,602 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 1506291)

- Donald Trump out this year? (24h volume: 862770)

- Will a bill that removes/changes the gambling tax provision that OBBB becomes law before Jan 1, 2026? (24h volume: 499752)

- Will Jack Ciattarelli win the 2025 New Jersey gubernatorial election? (24h volume: 442678)

- Will Mikie Sherrill finish within 100 to -0.01 percentage points in New Jersey? (24h volume: 258073)

- Will Curtis Sliwa drop out of the NYC Mayoral race? (24h volume: 142901)

- Will J.B. Pritzker be the Democratic Presidential nominee in 2028? (24h volume: 130888)

- Margin of victory for Zohran Mamdani in the Mayoral Election? (24h volume: 93280)

- Will Winsome Earle-Sears win the 2025 Virginia gubernatorial election? (24h volume: 91280)

- Will Abigail Spanberger win by 4 to 5.99 percentage points in Virginia? (24h volume: 75153)

Kalshi has reported 37,847 in volume over the last 24 hours on their market for “Powell leaves before 2026?”, making it one of the hottest markets on the platform today.

The market currently is implying a 5% chance for "Before 2026", which is neutral from yesterday, when the market implied a 5% probability.

If Jerome Powell is no longer Chair of the Federal Reserve Board of Governors (not merely announces he leaves office) by Dec 31, 2025, then the market resolves to Yes.

In total, this market has seen a volume of 6,002,314 transactions since it was first opened on May 01, 2024. There are 1,003,583 positions of open interest in this market, and the overall liquidity is sitting at 23,174,359 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 1506291)

- Donald Trump out this year? (24h volume: 862770)

- Will a bill that removes/changes the gambling tax provision that OBBB becomes law before Jan 1, 2026? (24h volume: 499752)

- Will Jack Ciattarelli win the 2025 New Jersey gubernatorial election? (24h volume: 442678)

- Will Mikie Sherrill finish within 100 to -0.01 percentage points in New Jersey? (24h volume: 258073)

- Will Curtis Sliwa drop out of the NYC Mayoral race? (24h volume: 142901)

- Will J.B. Pritzker be the Democratic Presidential nominee in 2028? (24h volume: 130888)

- Margin of victory for Zohran Mamdani in the Mayoral Election? (24h volume: 93280)

- Will Winsome Earle-Sears win the 2025 Virginia gubernatorial election? (24h volume: 91280)

- Will Abigail Spanberger win by 4 to 5.99 percentage points in Virginia? (24h volume: 75153)

Kalshi has reported 19,419 in volume over the last 24 hours on their market for “Will Trump create a National Bitcoin Reserve before Jan 1, 2026?”, making it one of the hottest markets on the platform today.

The market currently is implying a 15% chance for "Before Jan 1, 2026", which is neutral from yesterday, when the market implied a 15% probability.

If the White House creates a National Bitcoin Reserve (a la the Strategic Petroleum Reserve) before January 1, 2026, either through direct executive action or by signing a bill into law, then the market resolves to Yes.

In total, this market has seen a volume of 1,730,302 transactions since it was first opened on November 09, 2024. There are 365,872 positions of open interest in this market, and the overall liquidity is sitting at 60,120,525 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 1506291)

- Donald Trump out this year? (24h volume: 862770)

- Will a bill that removes/changes the gambling tax provision that OBBB becomes law before Jan 1, 2026? (24h volume: 499752)

- Will Jack Ciattarelli win the 2025 New Jersey gubernatorial election? (24h volume: 442678)

- Will Mikie Sherrill finish within 100 to -0.01 percentage points in New Jersey? (24h volume: 258073)

- Will Curtis Sliwa drop out of the NYC Mayoral race? (24h volume: 142901)

- Will J.B. Pritzker be the Democratic Presidential nominee in 2028? (24h volume: 130888)

- Margin of victory for Zohran Mamdani in the Mayoral Election? (24h volume: 93280)

- Will Winsome Earle-Sears win the 2025 Virginia gubernatorial election? (24h volume: 91280)

- Will Abigail Spanberger win by 4 to 5.99 percentage points in Virginia? (24h volume: 75153)

Kalshi has reported 16,082 in volume over the last 24 hours on their market for “Will government spending decrease by 1 before 2025?”, making it one of the hottest markets on the platform today.

The market currently is implying a 17% chance for "At least 1 billion", which is neutral from yesterday, when the market implied a 17% probability.

If government spending decreases by at least $1 billion during Q4 2024 to Q4 2025, then the market resolves to Yes.

In total, this market has seen a volume of 1,155,773 transactions since it was first opened on February 25, 2025. There are 280,926 positions of open interest in this market, and the overall liquidity is sitting at 10,340,700 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 1506291)

- Donald Trump out this year? (24h volume: 862770)

- Will a bill that removes/changes the gambling tax provision that OBBB becomes law before Jan 1, 2026? (24h volume: 499752)

- Will Jack Ciattarelli win the 2025 New Jersey gubernatorial election? (24h volume: 442678)

- Will Mikie Sherrill finish within 100 to -0.01 percentage points in New Jersey? (24h volume: 258073)

- Will Curtis Sliwa drop out of the NYC Mayoral race? (24h volume: 142901)

- Will J.B. Pritzker be the Democratic Presidential nominee in 2028? (24h volume: 130888)

- Margin of victory for Zohran Mamdani in the Mayoral Election? (24h volume: 93280)

- Will Winsome Earle-Sears win the 2025 Virginia gubernatorial election? (24h volume: 91280)

- Will Abigail Spanberger win by 4 to 5.99 percentage points in Virginia? (24h volume: 75153)

Rob Wittman marks one month of government shutdown, criticizing Senate Democrats for inaction impacting federal employees and veterans.

Quiver AI Summary

Congressman Wittman addresses government shutdown: Congressman Rob Wittman released a statement marking one month since the government shutdown, highlighting his vote on September 19 to keep the government funded. He criticized Senate Democrats for opposing funding measures and emphasized the effects on federal employees and veterans.

Call for cooperation: Wittman underscored the importance of returning to regular order in Congress and suggested that the current shutdown should prompt action to pass responsible appropriation bills. He reiterated his commitment to serving his constituents during this period of uncertainty.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Robert J. Wittman Net Worth

Quiver Quantitative estimates that Robert J. Wittman is worth $5.6M, as of November 1st, 2025. This is the 164th highest net worth in Congress, per our live estimates.

Wittman has approximately $941.3K invested in publicly traded assets which Quiver is able to track live.

You can track Robert J. Wittman's net worth on Quiver Quantitative's politician page for Wittman.

Robert J. Wittman Bill Proposals

Here are some bills which have recently been proposed by Robert J. Wittman:

- H.R.2969: Finding ORE Act

- H.R.2091: Chesapeake Bay Conservation Acceleration Act of 2025

- H.R.1151: Freedom to Invest in Tomorrow’s Workforce Act

- H.R.906: Foreign Adversary Communications Transparency Act

- H.R.556: Protecting Access for Hunters and Anglers Act of 2025

- H.R.555: Veterans Affairs Transfer of Information and Sharing of Disability Examination Procedures With DOD Doctors Act

You can track bills proposed by Robert J. Wittman on Quiver Quantitative's politician page for Wittman.

Robert J. Wittman Fundraising

Robert J. Wittman recently disclosed $366.5K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 260th most from all Q3 reports we have seen this year. 64.5% came from individual donors.

Wittman disclosed $140.1K of spending. This was the 437th most from all Q3 reports we have seen from politicians so far this year.

Wittman disclosed $2.8M of cash on hand at the end of the filing period. This was the 118th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Robert J. Wittman's fundraising on Quiver Quantitative.

CNO FINANCIAL GROUP ($CNO) is expected to release its quarterly earnings data on Monday, November 3rd after market close, per Finnhub. Analysts are expecting revenue of $983,238,535 and earnings of $0.93 per share.

You can see Quiver Quantitative's $CNO stock page to track data on insider trading, hedge fund activity, congressional trading, and more.

CNO FINANCIAL GROUP Insider Trading Activity

CNO FINANCIAL GROUP insiders have traded $CNO stock on the open market 9 times in the past 6 months. Of those trades, 0 have been purchases and 9 have been sales.

Here’s a breakdown of recent trading of $CNO stock by insiders over the last 6 months:

- KAREN J. DETORO (President, Worksite Division) has made 0 purchases and 3 sales selling 25,657 shares for an estimated $973,017.

- MICHAEL E. MEAD (Chief Information Officer) has made 0 purchases and 2 sales selling 24,970 shares for an estimated $950,902.

- JEANNE L. LINNENBRINGER (Chief Operations Officer) has made 0 purchases and 4 sales selling 14,739 shares for an estimated $559,204.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

CNO FINANCIAL GROUP Hedge Fund Activity

We have seen 143 institutional investors add shares of CNO FINANCIAL GROUP stock to their portfolio, and 194 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- BLACKROCK, INC. removed 980,567 shares (-6.9%) from their portfolio in Q2 2025, for an estimated $37,830,274

- ALLIANZ ASSET MANAGEMENT GMBH added 641,950 shares (+70.9%) to their portfolio in Q2 2025, for an estimated $24,766,431

- FIRST TRUST ADVISORS LP removed 571,880 shares (-36.8%) from their portfolio in Q2 2025, for an estimated $22,063,130

- LSV ASSET MANAGEMENT removed 356,595 shares (-9.2%) from their portfolio in Q2 2025, for an estimated $13,757,435

- HOTCHKIS & WILEY CAPITAL MANAGEMENT LLC removed 341,576 shares (-52.7%) from their portfolio in Q2 2025, for an estimated $13,178,002

- RETIREMENT SYSTEMS OF ALABAMA added 299,797 shares (+inf%) to their portfolio in Q3 2025, for an estimated $11,856,971

- AQR CAPITAL MANAGEMENT LLC removed 287,399 shares (-25.7%) from their portfolio in Q2 2025, for an estimated $11,087,853

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

CNO FINANCIAL GROUP Congressional Stock Trading

Members of Congress have traded $CNO stock 3 times in the past 6 months. Of those trades, 1 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $CNO stock by members of Congress over the last 6 months:

- REPRESENTATIVE LISA C. MCCLAIN has traded it 2 times. They made 1 purchase worth up to $15,000 on 06/09 and 1 sale worth up to $15,000 on 06/11.

- REPRESENTATIVE JEFFERSON SHREVE sold up to $50,000 on 05/12.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

PRIMORIS SERVICES ($PRIM) is expected to release its quarterly earnings data on Monday, November 3rd after market close, per Finnhub. Analysts are expecting revenue of $1,879,361,587 and earnings of $1.41 per share.

You can see Quiver Quantitative's $PRIM stock page to track data on insider trading, hedge fund activity, congressional trading, and more.

PRIMORIS SERVICES Insider Trading Activity

PRIMORIS SERVICES insiders have traded $PRIM stock on the open market 13 times in the past 6 months. Of those trades, 1 have been purchases and 12 have been sales.

Here’s a breakdown of recent trading of $PRIM stock by insiders over the last 6 months:

- JOHN P. SCHAUERMAN has made 0 purchases and 3 sales selling 35,000 shares for an estimated $3,440,779.

- JOHN M. PERISICH (CHIEF LEGAL AND ADMIN OFFICER) has made 0 purchases and 6 sales selling 27,302 shares for an estimated $3,019,166.

- TRAVIS STRICKER (CAO) sold 4,635 shares for an estimated $516,533

- JEREMY KINCH (CHIEF OPERATING OFFICER) sold 3,006 shares for an estimated $372,744

- MICHAEL E. CHING sold 2,935 shares for an estimated $351,877

- TERRY D MCCALLISTER purchased 11 shares for an estimated $1,618

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

PRIMORIS SERVICES Hedge Fund Activity

We have seen 216 institutional investors add shares of PRIMORIS SERVICES stock to their portfolio, and 207 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- NUVEEN, LLC removed 1,274,433 shares (-65.6%) from their portfolio in Q2 2025, for an estimated $99,329,308

- BLACKROCK, INC. removed 707,871 shares (-11.6%) from their portfolio in Q2 2025, for an estimated $55,171,465

- FIRST TRUST ADVISORS LP added 660,915 shares (+56.4%) to their portfolio in Q2 2025, for an estimated $51,511,715

- ARTEMIS INVESTMENT MANAGEMENT LLP added 656,090 shares (+inf%) to their portfolio in Q2 2025, for an estimated $51,135,654

- FULLER & THALER ASSET MANAGEMENT, INC. added 499,605 shares (+28.0%) to their portfolio in Q2 2025, for an estimated $38,939,213

- AMERICAN CENTURY COMPANIES INC added 418,805 shares (+229.3%) to their portfolio in Q2 2025, for an estimated $32,641,661

- HENNESSY ADVISORS INC added 364,600 shares (+inf%) to their portfolio in Q3 2025, for an estimated $50,070,518

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

PRIMORIS SERVICES Analyst Ratings

Wall Street analysts have issued reports on $PRIM in the last several months. We have seen 8 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Needham issued a "Buy" rating on 10/22/2025

- JP Morgan issued a "Overweight" rating on 10/16/2025

- UBS issued a "Buy" rating on 10/01/2025

- GLJ Research issued a "Buy" rating on 09/22/2025

- Keybanc issued a "Overweight" rating on 09/02/2025

- DA Davidson issued a "Buy" rating on 08/06/2025

- Janney Montgomery Scott issued a "Buy" rating on 07/03/2025

To track analyst ratings and price targets for PRIMORIS SERVICES, check out Quiver Quantitative's $PRIM forecast page.

PRIMORIS SERVICES Price Targets

Multiple analysts have issued price targets for $PRIM recently. We have seen 14 analysts offer price targets for $PRIM in the last 6 months, with a median target of $135.5.

Here are some recent targets:

- Sean Milligan from Needham set a target price of $175.0 on 10/22/2025

- Sangita Jain from Keybanc set a target price of $154.0 on 10/20/2025

- Mark Strouse from JP Morgan set a target price of $141.0 on 10/16/2025

- Philip Shen from Roth Capital set a target price of $170.0 on 10/09/2025

- Julien Dumoulin-Smith from Jefferies set a target price of $160.0 on 10/08/2025

- Steven Fisher from UBS set a target price of $158.0 on 10/01/2025

- Austin Wang from GLJ Research set a target price of $160.0 on 09/22/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

BWX TECHNOLOGIES ($BWXT) is expected to release its quarterly earnings data on Monday, November 3rd after market close, per Finnhub. Analysts are expecting revenue of $810,230,880 and earnings of $0.87 per share.

You can see Quiver Quantitative's $BWXT stock page to track data on insider trading, hedge fund activity, congressional trading, and more.

BWX TECHNOLOGIES Insider Trading Activity

BWX TECHNOLOGIES insiders have traded $BWXT stock on the open market 5 times in the past 6 months. Of those trades, 0 have been purchases and 5 have been sales.

Here’s a breakdown of recent trading of $BWXT stock by insiders over the last 6 months:

- REX D GEVEDEN (President and CEO) has made 0 purchases and 2 sales selling 25,000 shares for an estimated $4,475,097.

- OMAR FATHI MEGUID (SVP and Chief Digital Officer) sold 2,261 shares for an estimated $406,618

- RONALD OWEN JR WHITFORD (SVP, General Counsel and Sec.) sold 2,092 shares for an estimated $371,192

- LELAND D MELVIN sold 600 shares for an estimated $106,958

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

BWX TECHNOLOGIES Hedge Fund Activity

We have seen 343 institutional investors add shares of BWX TECHNOLOGIES stock to their portfolio, and 319 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- VALEO FINANCIAL ADVISORS, LLC added 1,513,092 shares (+33572.0%) to their portfolio in Q2 2025, for an estimated $217,976,033

- ARTISAN PARTNERS LIMITED PARTNERSHIP added 1,276,267 shares (+inf%) to their portfolio in Q2 2025, for an estimated $183,859,024

- WILLIAM BLAIR INVESTMENT MANAGEMENT, LLC added 1,273,895 shares (+523.2%) to their portfolio in Q2 2025, for an estimated $183,517,313

- INVESCO LTD. added 926,117 shares (+139.0%) to their portfolio in Q2 2025, for an estimated $133,416,415

- BLACKROCK, INC. added 743,928 shares (+7.8%) to their portfolio in Q2 2025, for an estimated $107,170,267

- ALKEON CAPITAL MANAGEMENT LLC added 600,048 shares (+inf%) to their portfolio in Q2 2025, for an estimated $86,442,914

- ARK INVESTMENT MANAGEMENT LLC added 519,285 shares (+426.5%) to their portfolio in Q2 2025, for an estimated $74,808,197

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

BWX TECHNOLOGIES Government Contracts

We have seen $51,740,724 of award payments to $BWXT over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

- ENRICHED URANIUM CONVERSION AND PURIFICATION SERVICES: $38,318,184

- THE CONTRACTOR SHALL PROCESS 3.6 MT OF HALEU: $13,152,171

- THE CONTRACTOR WILL PROVIDE CONTINUED STORAGE OF RADIOACTIVE WASTE AND SPENT NUCLEAR FUEL (SNF) LOCATED AT ...: $250,368

- REQUESTING 15K TO CREATE A FIBER OPTIC PATHWAY FROM THE TELCO DEMARC TO THE BWXT NRC RESIDENT OFFICE IN SUP...: $20,000

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

BWX TECHNOLOGIES Congressional Stock Trading

Members of Congress have traded $BWXT stock 1 times in the past 6 months. Of those trades, 1 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $BWXT stock by members of Congress over the last 6 months:

- REPRESENTATIVE LISA C. MCCLAIN purchased up to $15,000 on 06/11.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

BWX TECHNOLOGIES Analyst Ratings

Wall Street analysts have issued reports on $BWXT in the last several months. We have seen 4 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Northland Capital Markets issued a "Outperform" rating on 09/10/2025

- B of A Securities issued a "Buy" rating on 08/13/2025

- William Blair issued a "Outperform" rating on 05/28/2025

- CLSA issued a "Outperform" rating on 05/27/2025

To track analyst ratings and price targets for BWX TECHNOLOGIES, check out Quiver Quantitative's $BWXT forecast page.

BWX TECHNOLOGIES Price Targets

Multiple analysts have issued price targets for $BWXT recently. We have seen 6 analysts offer price targets for $BWXT in the last 6 months, with a median target of $175.3.

Here are some recent targets:

- Michael Ciarmoli from Truist Securities set a target price of $173.0 on 10/15/2025

- Jeff Grampp from Northland Capital Markets set a target price of $205.0 on 09/10/2025

- Ronald Epstein from B of A Securities set a target price of $220.0 on 08/13/2025

- Scott Deuschle from Deutsche Bank set a target price of $150.0 on 07/08/2025

- Max Hopkins from CLSA set a target price of $177.6 on 05/27/2025

- Tate Sullivan from Maxim Group set a target price of $136.0 on 05/08/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

CRESCENT ENERGY COMPANY ($CRGY) is expected to release its quarterly earnings data on Monday, November 3rd after market close, per Finnhub. Analysts are expecting revenue of $908,006,611 and earnings of $0.36 per share.

You can see Quiver Quantitative's $CRGY stock page to track data on insider trading, hedge fund activity, congressional trading, and more.

CRESCENT ENERGY COMPANY Hedge Fund Activity

We have seen 154 institutional investors add shares of CRESCENT ENERGY COMPANY stock to their portfolio, and 143 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- KOHLBERG KRAVIS ROBERTS & CO. L.P. added 26,185,773 shares (+4575.1%) to their portfolio in Q2 2025, for an estimated $225,197,647

- AMERICAN CENTURY COMPANIES INC added 3,960,998 shares (+28.4%) to their portfolio in Q2 2025, for an estimated $34,064,582

- DIMENSIONAL FUND ADVISORS LP added 3,266,329 shares (+53.1%) to their portfolio in Q2 2025, for an estimated $28,090,429

- HITE HEDGE ASSET MANAGEMENT LLC added 3,186,595 shares (+355.1%) to their portfolio in Q2 2025, for an estimated $27,404,717

- AVENTAIL CAPITAL GROUP, LP removed 2,118,129 shares (-51.5%) from their portfolio in Q2 2025, for an estimated $18,215,909

- NUVEEN, LLC removed 1,454,586 shares (-75.1%) from their portfolio in Q2 2025, for an estimated $12,509,439

- WOODLINE PARTNERS LP added 1,172,374 shares (+100.0%) to their portfolio in Q2 2025, for an estimated $10,082,416

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

CRESCENT ENERGY COMPANY Congressional Stock Trading

Members of Congress have traded $CRGY stock 2 times in the past 6 months. Of those trades, 1 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $CRGY stock by members of Congress over the last 6 months:

- REPRESENTATIVE LISA C. MCCLAIN has traded it 2 times. They made 1 purchase worth up to $15,000 on 06/09 and 1 sale worth up to $15,000 on 06/24.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

CRESCENT ENERGY COMPANY Analyst Ratings

Wall Street analysts have issued reports on $CRGY in the last several months. We have seen 4 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Wells Fargo issued a "Overweight" rating on 10/17/2025

- Raymond James issued a "Strong Buy" rating on 08/27/2025

- William Blair issued a "Outperform" rating on 08/25/2025

- Piper Sandler issued a "Overweight" rating on 07/17/2025

To track analyst ratings and price targets for CRESCENT ENERGY COMPANY, check out Quiver Quantitative's $CRGY forecast page.

CRESCENT ENERGY COMPANY Price Targets

Multiple analysts have issued price targets for $CRGY recently. We have seen 4 analysts offer price targets for $CRGY in the last 6 months, with a median target of $15.0.

Here are some recent targets:

- Hanwen Chang from Wells Fargo set a target price of $15.0 on 10/17/2025

- William Janela from Mizuho set a target price of $10.0 on 09/15/2025

- John Freeman from Raymond James set a target price of $17.0 on 08/27/2025

- Mark Lear from Piper Sandler set a target price of $15.0 on 07/17/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

EXACT SCIENCES ($EXAS) is expected to release its quarterly earnings data on Monday, November 3rd after market close, per Finnhub. Analysts are expecting revenue of $826,381,407 and earnings of -$0.07 per share.

You can see Quiver Quantitative's $EXAS stock page to track data on insider trading, hedge fund activity, congressional trading, and more.

EXACT SCIENCES Insider Trading Activity

EXACT SCIENCES insiders have traded $EXAS stock on the open market 5 times in the past 6 months. Of those trades, 0 have been purchases and 5 have been sales.

Here’s a breakdown of recent trading of $EXAS stock by insiders over the last 6 months:

- KATHERINE S ZANOTTI has made 0 purchases and 2 sales selling 15,207 shares for an estimated $950,612.

- JAMES EDWARD DOYLE has made 0 purchases and 2 sales selling 3,485 shares for an estimated $182,399.

- JAMES HERRIOTT (SVP, General Counsel & Sec) sold 1,500 shares for an estimated $90,000

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

EXACT SCIENCES Hedge Fund Activity

We have seen 260 institutional investors add shares of EXACT SCIENCES stock to their portfolio, and 281 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- PRICE T ROWE ASSOCIATES INC /MD/ removed 2,700,607 shares (-42.2%) from their portfolio in Q2 2025, for an estimated $143,510,255

- T. ROWE PRICE INVESTMENT MANAGEMENT, INC. removed 2,596,623 shares (-89.0%) from their portfolio in Q2 2025, for an estimated $137,984,546

- GOLDMAN SACHS GROUP INC added 1,486,137 shares (+204.1%) to their portfolio in Q2 2025, for an estimated $78,973,320

- HOLOCENE ADVISORS, LP added 1,404,086 shares (+189.5%) to their portfolio in Q2 2025, for an estimated $74,613,130

- BLACKROCK, INC. removed 1,388,121 shares (-11.6%) from their portfolio in Q2 2025, for an estimated $73,764,749

- STATE STREET CORP removed 1,234,872 shares (-18.7%) from their portfolio in Q2 2025, for an estimated $65,621,098

- UBS AM, A DISTINCT BUSINESS UNIT OF UBS ASSET MANAGEMENT AMERICAS LLC removed 1,219,545 shares (-39.0%) from their portfolio in Q2 2025, for an estimated $64,806,621

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

EXACT SCIENCES Government Contracts

We have seen $592,152 of award payments to $EXAS over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

- TESTING SERVICES FOR PATIENT CARE: $323,800

- ONCOTYPE CANCER TESTING - OY 5 POP: 16 MARCH 2025 TO 15 MARCH 2026: $124,588

- ONCOTYPE GENETIC TESTING SERVICES: $114,305

- GENETIC TESTING PREVENTIONGENETICS LLC:1126164 [25-010421]: $29,459

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

EXACT SCIENCES Analyst Ratings

Wall Street analysts have issued reports on $EXAS in the last several months. We have seen 5 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- BTIG issued a "Buy" rating on 10/22/2025

- Piper Sandler issued a "Overweight" rating on 10/08/2025

- Evercore ISI Group issued a "Outperform" rating on 10/07/2025

- Barclays issued a "Overweight" rating on 10/02/2025

- Craig-Hallum issued a "Buy" rating on 09/11/2025

To track analyst ratings and price targets for EXACT SCIENCES, check out Quiver Quantitative's $EXAS forecast page.

EXACT SCIENCES Price Targets

Multiple analysts have issued price targets for $EXAS recently. We have seen 7 analysts offer price targets for $EXAS in the last 6 months, with a median target of $68.0.

Here are some recent targets:

- Mark Massaro from BTIG set a target price of $75.0 on 10/22/2025

- David Westenberg from Piper Sandler set a target price of $70.0 on 10/08/2025

- Vijay Kumar from Evercore ISI Group set a target price of $68.0 on 10/07/2025

- Luke Sergott from Barclays set a target price of $65.0 on 10/02/2025

- Alex Nowark from Craig-Hallum set a target price of $85.0 on 09/11/2025

- Dan Leonard from UBS set a target price of $53.0 on 08/07/2025

- Conor McNamara from RBC Capital set a target price of $46.0 on 08/07/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

CLOROX|DE ($CLX) is expected to release its quarterly earnings data on Monday, November 3rd after market close, per Finnhub. Analysts are expecting revenue of $1,413,839,581 and earnings of $0.79 per share.

You can see Quiver Quantitative's $CLX stock page to track data on insider trading, hedge fund activity, congressional trading, and more.

CLOROX|DE Insider Trading Activity

CLOROX|DE insiders have traded $CLX stock on the open market 2 times in the past 6 months. Of those trades, 1 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $CLX stock by insiders over the last 6 months:

- ERIC H REYNOLDS (EVP - Chief Operating Officer) sold 15,041 shares for an estimated $1,861,847

- PIERRE R BREBER purchased 4,000 shares for an estimated $546,285

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

CLOROX|DE Hedge Fund Activity

We have seen 514 institutional investors add shares of CLOROX|DE stock to their portfolio, and 575 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- INVESCO LTD. added 1,883,465 shares (+138.3%) to their portfolio in Q2 2025, for an estimated $226,147,642

- QUBE RESEARCH & TECHNOLOGIES LTD added 1,684,594 shares (+250.2%) to their portfolio in Q2 2025, for an estimated $202,269,201

- VAN ECK ASSOCIATES CORP added 1,362,163 shares (+3854.7%) to their portfolio in Q2 2025, for an estimated $163,554,911

- BLACKROCK, INC. removed 1,342,815 shares (-11.3%) from their portfolio in Q2 2025, for an estimated $161,231,797

- TWO SIGMA INVESTMENTS, LP added 1,229,023 shares (+1722.4%) to their portfolio in Q2 2025, for an estimated $147,568,791

- MILLENNIUM MANAGEMENT LLC added 905,607 shares (+153.5%) to their portfolio in Q2 2025, for an estimated $108,736,232

- HOLOCENE ADVISORS, LP removed 863,437 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $103,672,880

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

CLOROX|DE Congressional Stock Trading

Members of Congress have traded $CLX stock 1 times in the past 6 months. Of those trades, 1 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $CLX stock by members of Congress over the last 6 months:

- REPRESENTATIVE LISA C. MCCLAIN purchased up to $15,000 on 06/24.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

CLOROX|DE Analyst Ratings

Wall Street analysts have issued reports on $CLX in the last several months. We have seen 1 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- Barclays issued a "Underweight" rating on 10/01/2025

- Jefferies issued a "Buy" rating on 06/26/2025

To track analyst ratings and price targets for CLOROX|DE, check out Quiver Quantitative's $CLX forecast page.

CLOROX|DE Price Targets

Multiple analysts have issued price targets for $CLX recently. We have seen 8 analysts offer price targets for $CLX in the last 6 months, with a median target of $127.5.

Here are some recent targets:

- Andrea Teixeira from JP Morgan set a target price of $127.0 on 10/10/2025

- Filippo Falorni from Citigroup set a target price of $130.0 on 10/09/2025

- Anna Lizzul from B of A Securities set a target price of $125.0 on 10/08/2025

- Peter Grom from UBS set a target price of $128.0 on 10/08/2025

- Lauren Lieberman from Barclays set a target price of $112.0 on 10/01/2025

- Chris Carey from Wells Fargo set a target price of $125.0 on 09/25/2025

- Dara Mohsenian from Morgan Stanley set a target price of $137.0 on 08/01/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

INSPERITY ($NSP) is expected to release its quarterly earnings data on Monday, November 3rd after market close, per Finnhub. Analysts are expecting revenue of $1,648,340,604 and earnings of $0.23 per share.

You can see Quiver Quantitative's $NSP stock page to track data on insider trading, hedge fund activity, congressional trading, and more.

INSPERITY Insider Trading Activity

INSPERITY insiders have traded $NSP stock on the open market 15 times in the past 6 months. Of those trades, 9 have been purchases and 6 have been sales.

Here’s a breakdown of recent trading of $NSP stock by insiders over the last 6 months:

- PAUL J SARVADI (Chairman of the Board & CEO) has made 0 purchases and 6 sales selling 44,791 shares for an estimated $2,777,774.

- JOHN L LUMELLEAU purchased 5,500 shares for an estimated $249,480

- CAROL R KAUFMAN purchased 5,000 shares for an estimated $226,200

- JAMES D ALLISON (EVP, Finance, CFO & Treasurer) purchased 4,000 shares for an estimated $187,280

- ELI JONES has made 2 purchases buying 2,204 shares for an estimated $100,092 and 0 sales.

- TIM CLIFFORD purchased 1,935 shares for an estimated $100,039

- RANDALL MEHL purchased 2,000 shares for an estimated $90,100

- LATHA RAMCHAND purchased 1,000 shares for an estimated $50,640

- ELLEN H MASTERSON purchased 490 shares for an estimated $22,197

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

INSPERITY Hedge Fund Activity

We have seen 133 institutional investors add shares of INSPERITY stock to their portfolio, and 186 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- HAWK RIDGE CAPITAL MANAGEMENT LP added 791,500 shares (+inf%) to their portfolio in Q2 2025, for an estimated $47,584,980

- T. ROWE PRICE INVESTMENT MANAGEMENT, INC. removed 520,637 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $31,300,696

- BLACKROCK, INC. removed 494,634 shares (-10.4%) from their portfolio in Q2 2025, for an estimated $29,737,396

- REINHART PARTNERS, LLC. added 415,373 shares (+23.2%) to their portfolio in Q3 2025, for an estimated $20,436,351

- ROYCE & ASSOCIATES LP added 386,139 shares (+1457.7%) to their portfolio in Q2 2025, for an estimated $23,214,676

- DIAMOND HILL CAPITAL MANAGEMENT INC removed 357,174 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $21,473,300

- MAWER INVESTMENT MANAGEMENT LTD. removed 262,380 shares (-5.1%) from their portfolio in Q2 2025, for an estimated $15,774,285

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

INSPERITY Analyst Ratings

Wall Street analysts have issued reports on $NSP in the last several months. We have seen 1 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Roth Capital issued a "Buy" rating on 08/04/2025

To track analyst ratings and price targets for INSPERITY, check out Quiver Quantitative's $NSP forecast page.

INSPERITY Price Targets

Multiple analysts have issued price targets for $NSP recently. We have seen 3 analysts offer price targets for $NSP in the last 6 months, with a median target of $51.0.

Here are some recent targets:

- Tobey Sommer from Truist Securities set a target price of $50.0 on 08/04/2025

- Andrew Polkowitz from JP Morgan set a target price of $51.0 on 08/04/2025

- Jeff Martin from Roth Capital set a target price of $74.0 on 08/04/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

BOISE CASCADE ($BCC) is expected to release its quarterly earnings data on Monday, November 3rd after market close, per Finnhub. Analysts are expecting revenue of $1,639,538,767 and earnings of $0.69 per share.

You can see Quiver Quantitative's $BCC stock page to track data on insider trading, hedge fund activity, congressional trading, and more.

BOISE CASCADE Insider Trading Activity

BOISE CASCADE insiders have traded $BCC stock on the open market 5 times in the past 6 months. Of those trades, 0 have been purchases and 5 have been sales.

Here’s a breakdown of recent trading of $BCC stock by insiders over the last 6 months:

- JILL TWEDT (SVP General Counsel & Corp Sec) has made 0 purchases and 2 sales selling 2,982 shares for an estimated $255,245.

- TROY LITTLE (EVP, Wood Products) sold 2,033 shares for an estimated $168,946

- JEFFREY ROBERT STROM (COO) sold 1,000 shares for an estimated $91,063

- JOANNA L. BARNEY (EVP, BMD) sold 1,000 shares for an estimated $87,679

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

BOISE CASCADE Hedge Fund Activity

We have seen 157 institutional investors add shares of BOISE CASCADE stock to their portfolio, and 199 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- PRICE T ROWE ASSOCIATES INC /MD/ removed 253,048 shares (-87.6%) from their portfolio in Q2 2025, for an estimated $21,969,627

- BLACKROCK, INC. removed 237,239 shares (-3.5%) from their portfolio in Q2 2025, for an estimated $20,597,089

- MARSHALL WACE, LLP removed 207,485 shares (-91.0%) from their portfolio in Q2 2025, for an estimated $18,013,847

- MILLENNIUM MANAGEMENT LLC added 190,640 shares (+154.6%) to their portfolio in Q2 2025, for an estimated $16,551,364