H.R. 1615: Strengthening Exports Against China Act

The bill known as the "Strengthening Exports Against China Act" seeks to amend the Export-Import Bank Act of 1945. Its primary focus is to change how the Export-Import Bank calculates default rates for financing provided to certain entities. Here are the key points of what the bill would do:

1. Exclusion of Financing from Default Rate Calculations

The bill proposes that when determining default rates, the Export-Import Bank should exclude specific financing from its calculations. This means that if a financing entity defaults, it won't necessarily count against the default rate if it meets certain criteria outlined in the bill.

2. Criteria for Exclusion

The bill sets two main criteria for financing to be excluded from default calculations:

- The financing must facilitate competition with products or services offered by certain entities. These entities include those listed on:

- The Entity List maintained by the Bureau of Industry and Security (BIS) of the Department of Commerce.

- Individuals or entities on the Specially Designated Nationals and Blocked Persons list maintained by the Office of Foreign Assets Control (OFAC) of the Department of the Treasury.

- The financing must have been provided under the "Program on China and Transformational Exports," which is a specific program established under previous legislation.

3. Purpose of the Bill

The intent behind these amendments is to strengthen U.S. exports against competition from China by providing more favorable financing conditions for domestic companies seeking to replace or compete with foreign products. This approach aims to support U.S. manufacturers and enhance competitiveness in the global market.

4. Impact on Export-Import Bank Operations

With these changes, the Export-Import Bank would have greater discretion in determining how defaults are assessed, potentially allowing for more financing opportunities for businesses engaged in competitive markets against certain foreign entities.

Relevant Companies

- BA (Boeing) - May benefit from increased financing for exporting aircraft and parts, especially if targeting market segments dominated by foreign competitors.

- GM (General Motors) - Potentially advantageous conditions for exporting vehicles and products that compete with foreign manufacturers.

- TSLA (Tesla) - Could receive easier access to financing for exports aimed at competing against traditional automakers in China.

This is an AI-generated summary of the bill text. There may be mistakes.

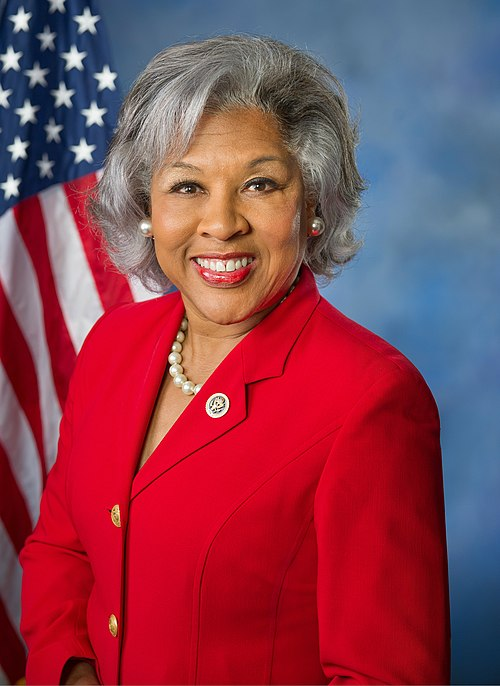

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 26, 2025 | Introduced in House |

| Feb. 26, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.